- Sweden

- /

- Capital Markets

- /

- OM:HAV B

The Havsfrun Investment (STO:HAV B) Share Price Is Down 15% So Some Shareholders Are Getting Worried

While not a mind-blowing move, it is good to see that the Havsfrun Investment AB (publ) (STO:HAV B) share price has gained 18% in the last three months. But if you look at the last five years the returns have not been good. In fact, the share price is down 15%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for Havsfrun Investment

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

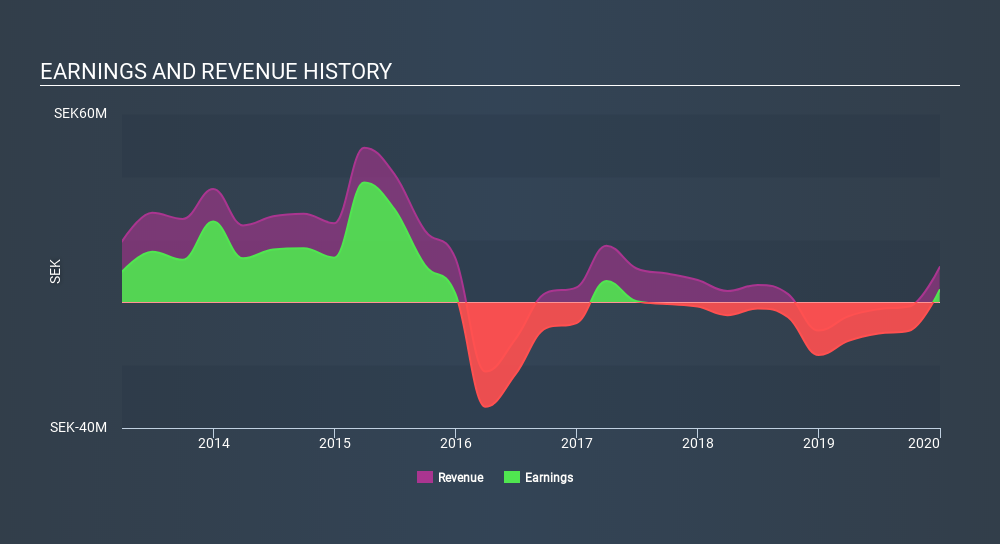

Havsfrun Investment became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The steady dividend doesn't really explain why the share price is down. It could be that the revenue decline of 42% per year is viewed as evidence that Havsfrun Investment is shrinking. With revenue weak, and increased payouts of cash, the market might be taking the view that its best days are behind it.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Havsfrun Investment's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Havsfrun Investment the TSR over the last 5 years was 21%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Havsfrun Investment provided a TSR of 19% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 3.9% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Havsfrun Investment better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Havsfrun Investment you should be aware of, and 2 of them can't be ignored.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OM:HAV B

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives