- Canada

- /

- Electrical

- /

- TSXV:GBLT

The GBLT (CVE:GBLT) Share Price Is Down 79% So Some Shareholders Are Rather Upset

Even the best investor on earth makes unsuccessful investments. But serious investors should think long and hard about avoiding extreme losses. So we hope that those who held GBLT Corp. (CVE:GBLT) during the last year don't lose the lesson, in addition to the 79% hit to the value of their shares. That'd be enough to make even the strongest stomachs churn. GBLT hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 62% in about a quarter. That's not much fun for holders.

View our latest analysis for GBLT

GBLT isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

GBLT's revenue didn't grow at all in the last year. In fact, it fell 3.2%. That looks pretty grim, at a glance. The share price fall of 79% in a year tells the story. That's a stern reminder that profitless companies need to grow the top line, at the very least. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

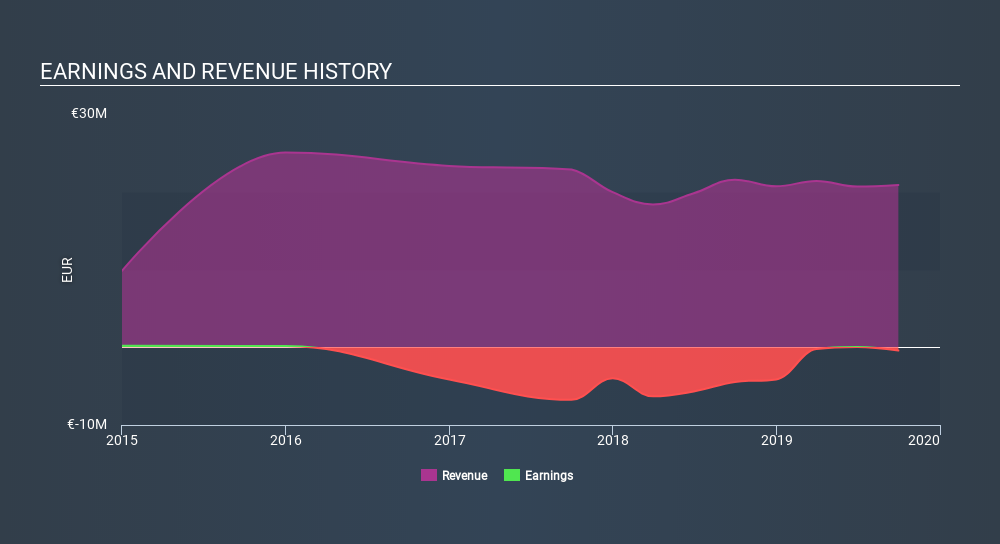

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

GBLT shareholders are down 79% for the year, even worse than the market loss of 18%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 62%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for GBLT (2 are a bit unpleasant!) that you should be aware of before investing here.

We will like GBLT better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:GBLT

GBLT

Through its subsidiaries, manufactures and distributes mobile power products in Germany, European Union, and internationally.

Good value with imperfect balance sheet.

Market Insights

Community Narratives