The EVA Precision Industrial Holdings (HKG:838) Share Price Is Down 68% So Some Shareholders Are Wishing They Sold

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example, after five long years the EVA Precision Industrial Holdings Limited (HKG:838) share price is a whole 68% lower. We certainly feel for shareholders who bought near the top. The falls have accelerated recently, with the share price down 16% in the last three months.

See our latest analysis for EVA Precision Industrial Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

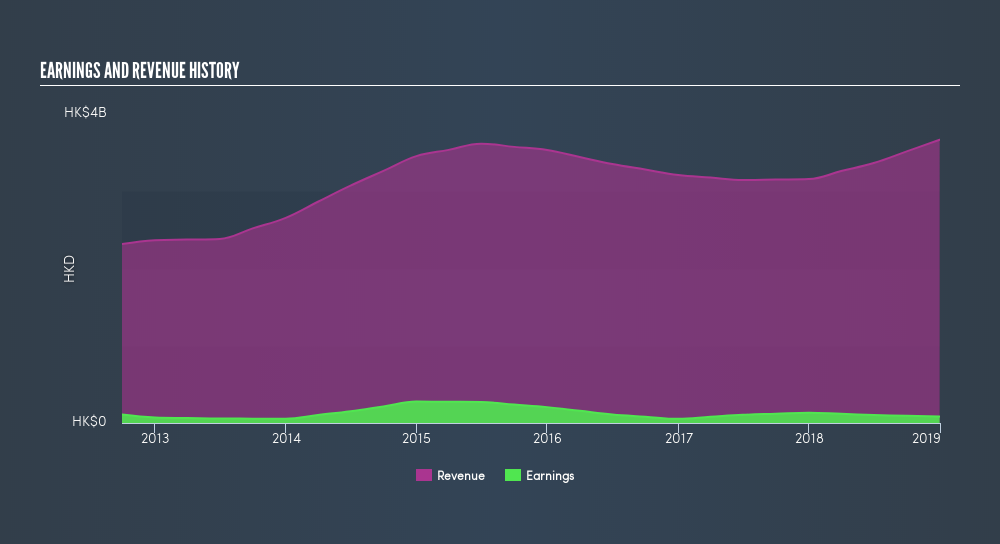

During the unfortunate half decade during which the share price slipped, EVA Precision Industrial Holdings actually saw its earnings per share (EPS) improve by 7.6% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past. Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

Revenue is actually up 1.7% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

This free interactive report on EVA Precision Industrial Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of EVA Precision Industrial Holdings, it has a TSR of -65% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that EVA Precision Industrial Holdings shareholders are down 17% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 7.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. However, the loss over the last year isn't as bad as the 19% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. If you would like to research EVA Precision Industrial Holdings in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course EVA Precision Industrial Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:838

EVA Precision Industrial Holdings

An investment holding company, provides precision manufacturing services in the People’s Republic of China, Vietnam, and Mexico.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives