- Canada

- /

- Electrical

- /

- TSX:DYA

The dynaCERT (CVE:DYA) Share Price Has Soared 323%, Delighting Many Shareholders

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. To wit, the dynaCERT Inc. (CVE:DYA) share price has soared 323% over five years. If that doesn't get you thinking about long term investing, we don't know what will. It's down 37% in the last seven days.

View our latest analysis for dynaCERT

We don't think dynaCERT's revenue of CA$235,350 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that dynaCERT can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Of course, if you time it right, high risk investments like this can really pay off, as dynaCERT investors might know.

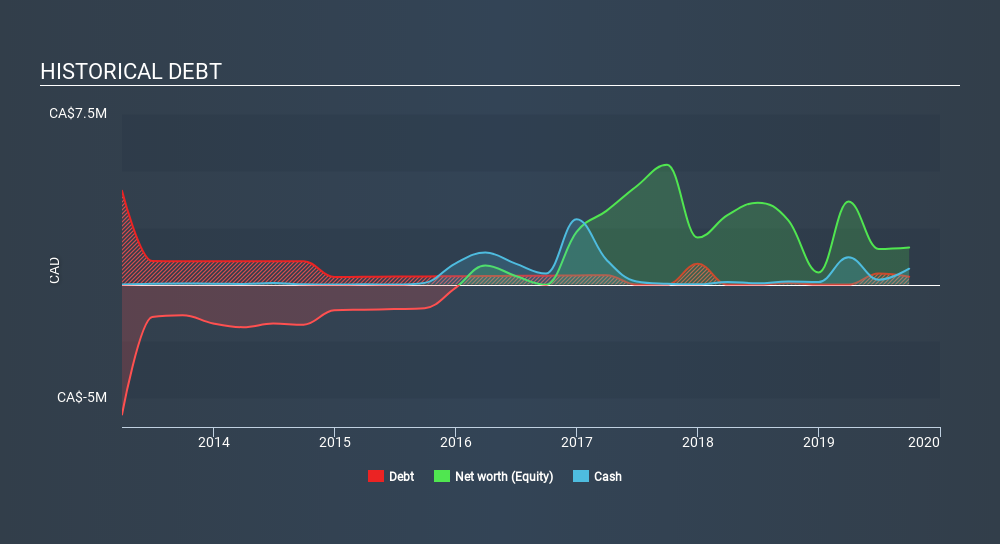

Our data indicates that dynaCERT had CA$2.2m more in total liabilities than it had cash, when it last reported in September 2019. That makes it extremely high risk, in our view. So we're surprised to see the stock up 56% per year, over 5 years , but we're happy for holders. It's clear more than a few people believe in the potential. You can click on the image below to see (in greater detail) how dynaCERT's cash levels have changed over time. The image below shows how dynaCERT's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

We're pleased to report that dynaCERT shareholders have received a total shareholder return of 55% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 33% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - dynaCERT has 6 warning signs (and 3 which are a bit concerning) we think you should know about.

dynaCERT is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:DYA

dynaCERT

Engages in the design, engineering, manufacture, testing, and distribution of transportable hydrogen generator aftermarket products in Europe, Canada, and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion