- Singapore

- /

- Construction

- /

- SGX:C06

The CSC Holdings (SGX:C06) Share Price Is Down 56% So Some Shareholders Are Wishing They Sold

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. Zooming in on an example, the CSC Holdings Limited (SGX:C06) share price dropped 56% in the last half decade. That's an unpleasant experience for long term holders. There was little comfort for shareholders in the last week as the price declined a further 5.6%.

Check out our latest analysis for CSC Holdings

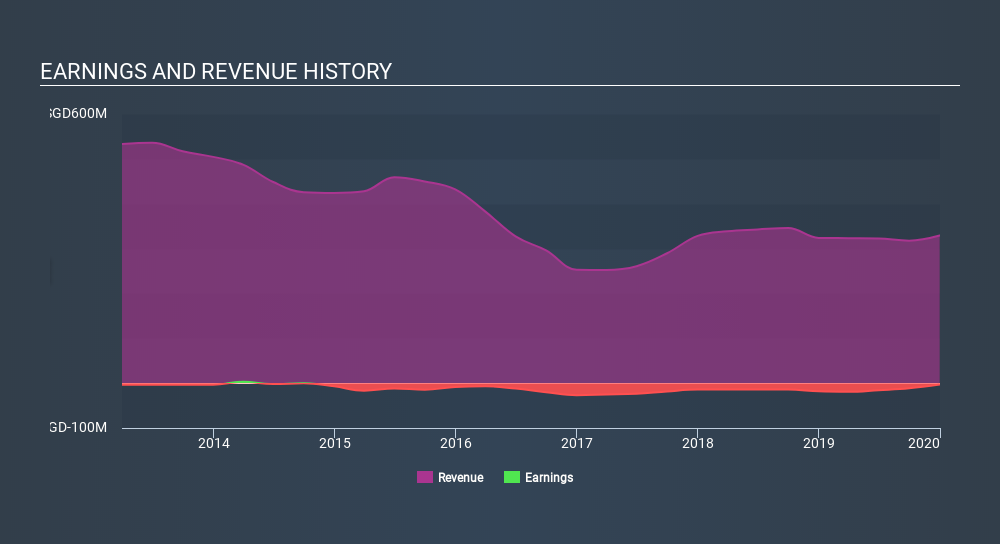

Because CSC Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade CSC Holdings reduced its trailing twelve month revenue by 6.6% for each year. That's not what investors generally want to see. The share price decline of 15% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. The chance of imminent investor enthusiasm for this stock seems slimmer than Louise Brooks. Not that many investors like to invest in companies that are losing money and not growing revenue.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on CSC Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between CSC Holdings's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. CSC Holdings's TSR of was a loss of 53% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

The total return of 15% received by CSC Holdings shareholders over the last year isn't far from the market return of -15%. Unfortunately, last year's performance is a deterioration of an already poor long term track record, given the loss of 14% per year over the last five years. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. It's always interesting to track share price performance over the longer term. But to understand CSC Holdings better, we need to consider many other factors. Even so, be aware that CSC Holdings is showing 5 warning signs in our investment analysis , and 1 of those can't be ignored...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:C06

CSC Holdings

An investment holding company, provides foundation and geotechnical, and ground engineering solutions in Singapore, Malaysia, India, Thailand, the Philippines, Vietnam, and internationally.

Moderate second-rate dividend payer.

Market Insights

Community Narratives