- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8051

The CircuTech International Holdings (HKG:8051) Share Price Is Down 65% So Some Shareholders Are Wishing They Sold

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of CircuTech International Holdings Limited (HKG:8051) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 65% drop in the share price over that period. The last week also saw the share price slip down another 13%. However, this move may have been influenced by the broader market, which fell 8.1% in that time.

Check out our latest analysis for CircuTech International Holdings

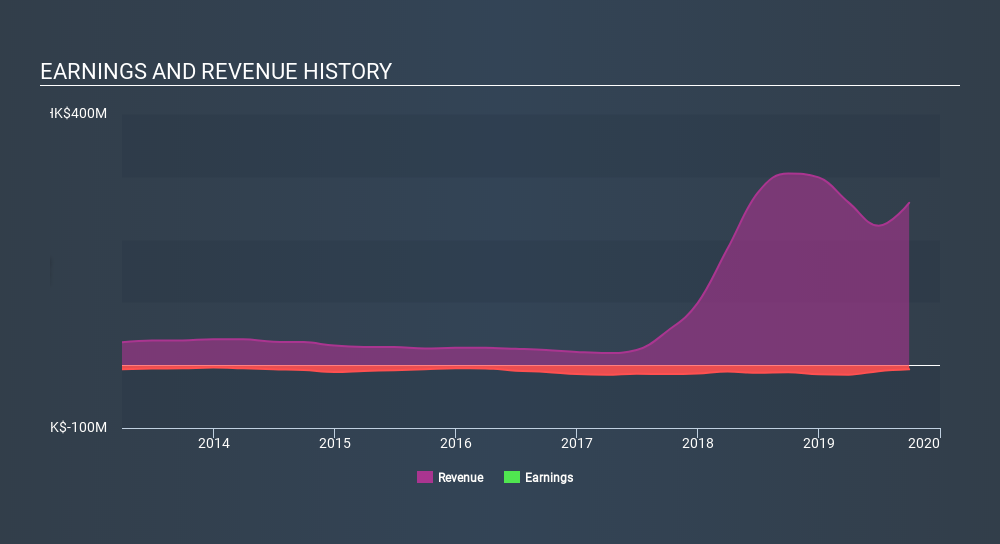

CircuTech International Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, CircuTech International Holdings grew revenue at 68% per year. That is faster than most pre-profit companies. The share price has moved in quite the opposite direction, down 30% over that time, a bad result. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between CircuTech International Holdings's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. CircuTech International Holdings hasn't been paying dividends, but its TSR of -61% exceeds its share price return of -65%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that CircuTech International Holdings shareholders have received a total shareholder return of 16% over the last year. Notably the five-year annualised TSR loss of 14% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand CircuTech International Holdings better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with CircuTech International Holdings (including 1 which is can't be ignored) .

But note: CircuTech International Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:8051

CircuTech International Holdings

An investment holding company, engages in sale and distribution of IT products, and provision of repair and other support services for IT products in Hong Kong, Japan, the United States, Australia, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives