- Hong Kong

- /

- Tech Hardware

- /

- SEHK:8111

The China Technology Solar Power Holdings (HKG:8111) Share Price Is Down 42% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term China Technology Solar Power Holdings Limited (HKG:8111) shareholders for doubting their decision to hold, with the stock down 42% over a half decade. Even worse, it's down 12% in about a month, which isn't fun at all.

Check out our latest analysis for China Technology Solar Power Holdings

Given that China Technology Solar Power Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, China Technology Solar Power Holdings saw its revenue increase by 2.5% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 10% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

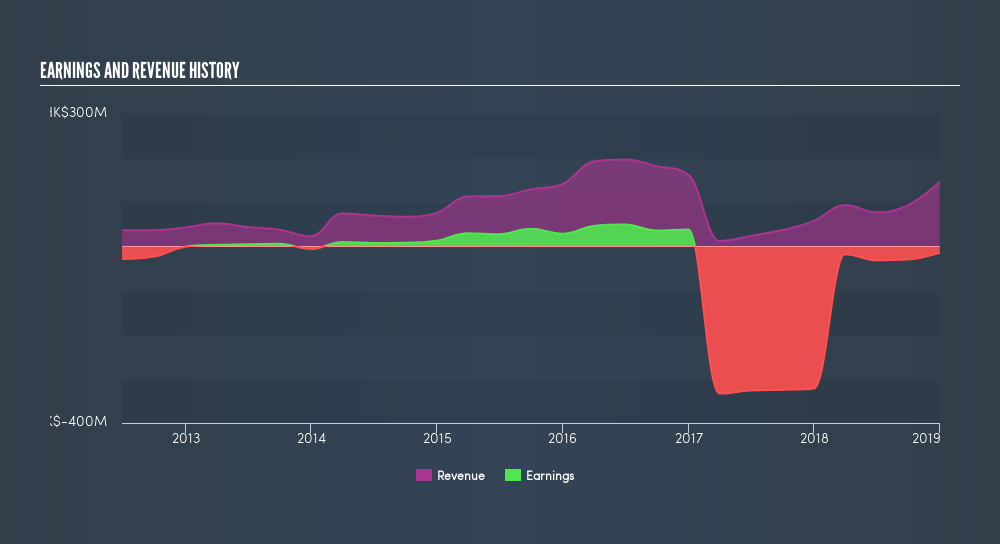

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that China Technology Solar Power Holdings shareholders have received a total shareholder return of 1.1% over the last year. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like China Technology Solar Power Holdings better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:8111

China Technology Industry Group

An investment holding company, engages in the sales of the renewable energy products business and new energy power system integration and electricity business in Hong Kong.

Adequate balance sheet and fair value.

Market Insights

Community Narratives