- United States

- /

- Banks

- /

- NasdaqGS:CBTX

The CBTX (NASDAQ:CBTX) Share Price Is Down 18% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the CBTX, Inc. (NASDAQ:CBTX) share price is down 18% in the last year. That's well bellow the market return of 6.4%. CBTX may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 14% in the last three months.

Check out our latest analysis for CBTX

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

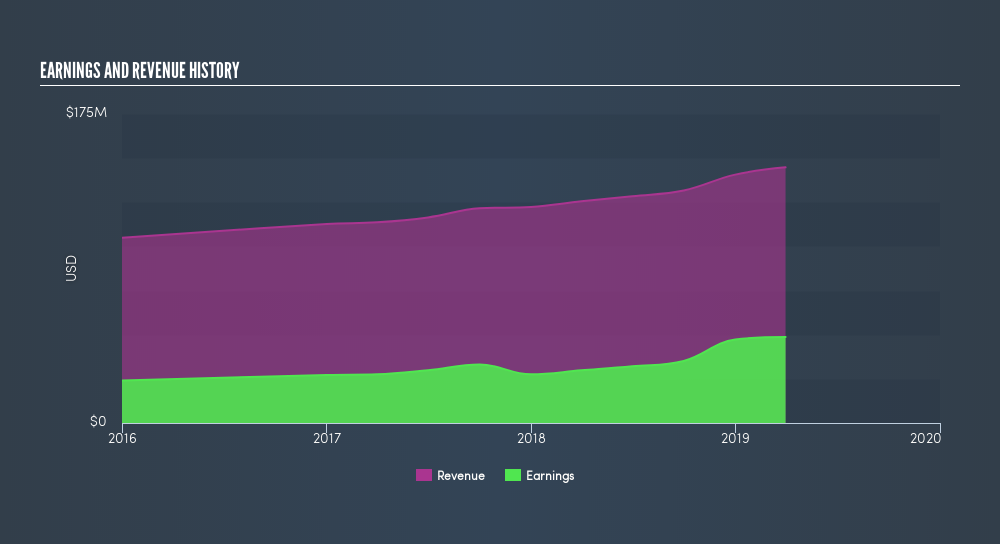

During the unfortunate twelve months during which the CBTX share price fell, it actually saw its earnings per share (EPS) improve by 52%. Of course, the situation might betray previous over-optimism about growth. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

With a low yield of 1.4% we doubt that the dividend influences the share price much. CBTX managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

We know that CBTX has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on CBTX

A Different Perspective

Given that the market gained 6.4% in the last year, CBTX shareholders might be miffed that they lost 17% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 14% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Before forming an opinion on CBTX you might want to consider these 3 valuation metrics.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:CBTX

CBTX

CBTX, Inc. operates as the bank holding company for CommunityBank of Texas, National Association that provides commercial banking products and services to small and mid-sized businesses, and professionals in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives