- United States

- /

- Commercial Services

- /

- NYSE:BV

The BrightView Holdings (NYSE:BV) Share Price Is Down 28% So Some Shareholders Are Getting Worried

BrightView Holdings, Inc. (NYSE:BV) shareholders should be happy to see the share price up 15% in the last month. But that doesn't change the reality of under-performance over the last twelve months. In fact the stock is down 28% in the last year, well below the market return.

See our latest analysis for BrightView Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year BrightView Holdings grew its earnings per share, moving from a loss to a profit.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

BrightView Holdings managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

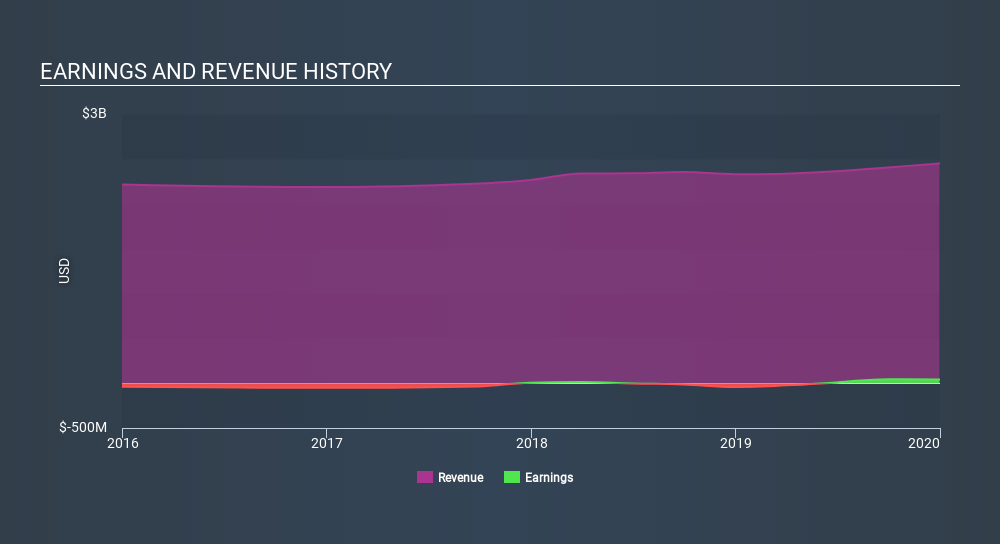

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that BrightView Holdings has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

BrightView Holdings shareholders are down 28% for the year, even worse than the market loss of 3.5%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's worth noting that the last three months did the real damage, with a 36% decline. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for BrightView Holdings (1 is concerning) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:BV

BrightView Holdings

Through its subsidiaries, provides commercial landscaping services in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives