- Australia

- /

- Consumer Durables

- /

- ASX:AVJ

The AVJennings (ASX:AVJ) Share Price Is Down 25% So Some Shareholders Are Getting Worried

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term AVJennings Limited (ASX:AVJ) shareholders have had that experience, with the share price dropping 25% in three years, versus a market return of about 2.0%. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 22% in the same timeframe.

Check out our latest analysis for AVJennings

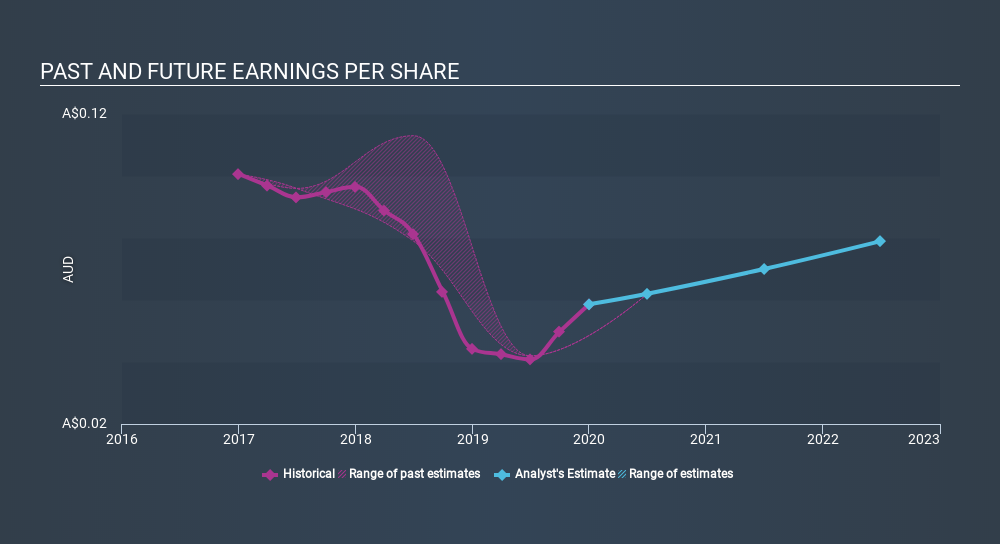

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, AVJennings's earnings per share (EPS) dropped by 16% each year. In comparison the 9.2% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that AVJennings has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, AVJennings's TSR for the last 3 years was -8.2%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that AVJennings shareholders have received a total shareholder return of 0.6% over one year. That's including the dividend. Having said that, the five-year TSR of 1.3% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for AVJennings you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:AVJ

AVJennings

Engages in the development of residential properties in Australia and New Zealand.

Slight and slightly overvalued.

Market Insights

Community Narratives