The Alexium International Group (ASX:AJX) Share Price Is Down 73% So Some Shareholders Are Rather Upset

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Alexium International Group Limited (ASX:AJX); the share price is down a whopping 73% in the last three years. That would certainly shake our confidence in the decision to own the stock. Unfortunately the share price momentum is still quite negative, with prices down 12% in thirty days.

Check out our latest analysis for Alexium International Group

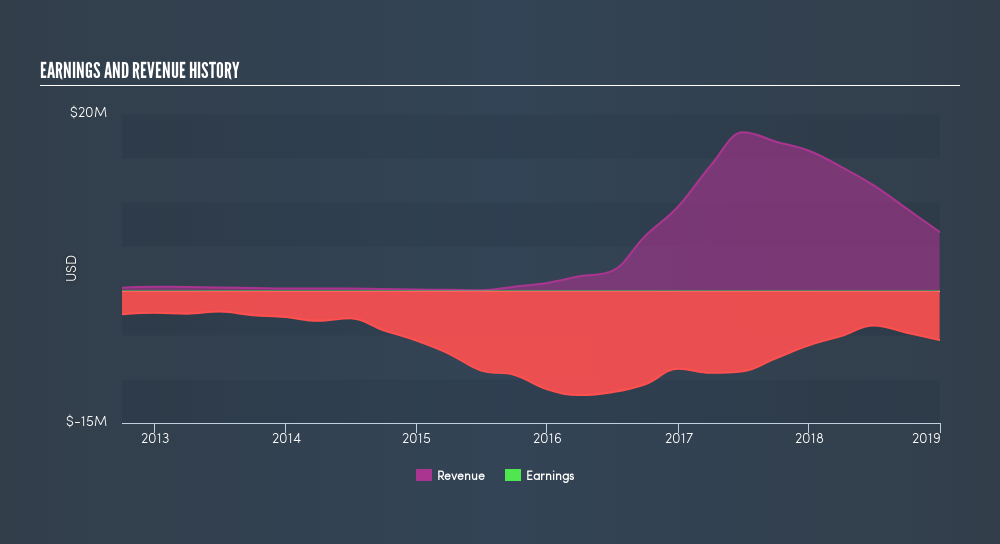

Alexium International Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Alexium International Group saw its revenue grow by 34% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 36% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Alexium International Group had a tough year, with a total loss of 9.1%, against a market gain of about 5.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 2.1% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of Alexium International Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:AJX

Alexium International Group

Manufactures and sells phase-change material (PCM) and other specialty textile solutions in the United States.

Mediocre balance sheet low.

Market Insights

Community Narratives