- United States

- /

- Biotech

- /

- NasdaqGS:ACAD

The ACADIA Pharmaceuticals (NASDAQ:ACAD) Share Price Has Gained 80% And Shareholders Are Hoping For More

It might be of some concern to shareholders to see the ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) share price down 10% in the last month. But that doesn't change the reality that over twelve months the stock has done really well. In that time we've seen the stock easily surpass the market return, with a gain of 80%.

View our latest analysis for ACADIA Pharmaceuticals

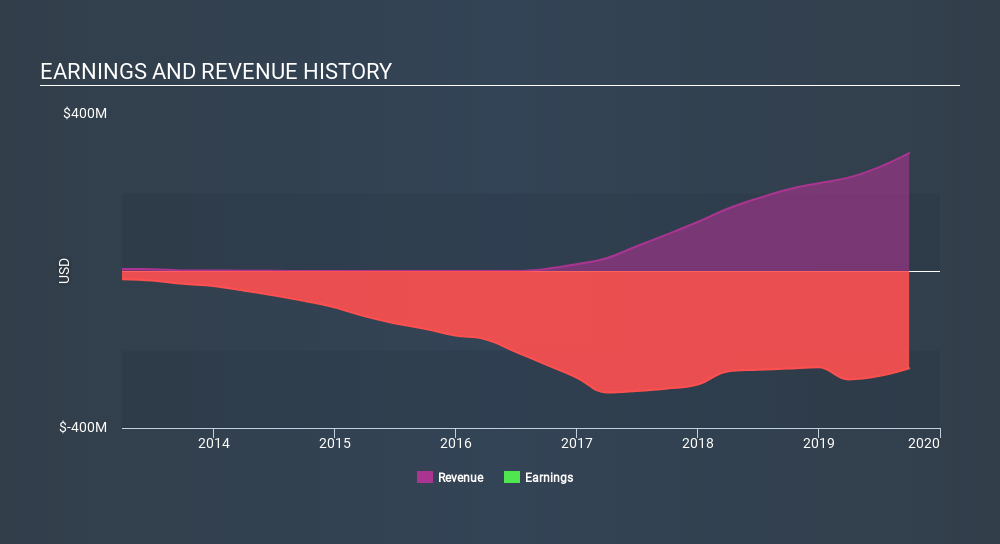

ACADIA Pharmaceuticals isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

ACADIA Pharmaceuticals grew its revenue by 45% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 80% over twelve months, you could argue the revenue growth warranted it. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

ACADIA Pharmaceuticals is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that ACADIA Pharmaceuticals shareholders have received a total shareholder return of 80% over the last year. That's better than the annualised return of 6.0% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with ACADIA Pharmaceuticals .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:ACAD

ACADIA Pharmaceuticals

A biopharmaceutical company, focuses on the development and commercialization of medicines for central nervous system (CNS) disorders and rare diseases in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives