- United States

- /

- Biotech

- /

- NasdaqCM:TGTX

TG Therapeutics (NasdaqCM:TGTX) Stock Rises 13% In Last Month

Reviewed by Simply Wall St

TG Therapeutics (NasdaqCM:TGTX) saw its share price rise by 13% last month. This period witnessed significant market fluctuations, such as the S&P 500 hitting 6,000 for the first time since February and strong job reports boosting economic sentiment. These positive macroeconomic developments likely provided a supportive backdrop for TG Therapeutics' stock performance. While specific corporate events for TG Therapeutics were not highlighted, broader economic trends, including subsiding tariff concerns and robust corporate earnings, may have indirectly influenced its upward price movement, complementing the overall positive sentiment in the equity markets.

Be aware that TG Therapeutics is showing 1 warning sign in our investment analysis.

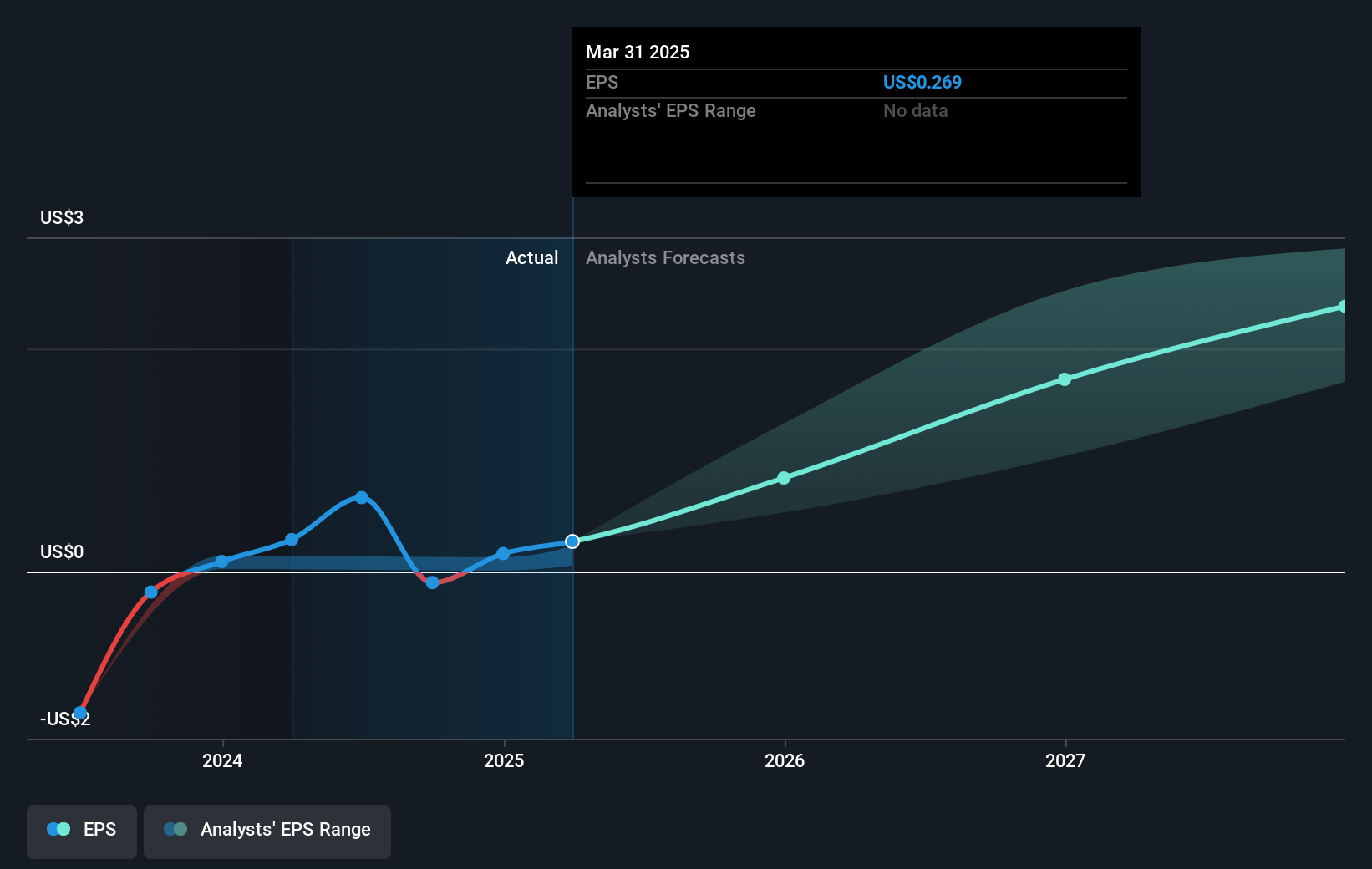

The recent surge in TG Therapeutics's share price, amid broader market positivity, aligns well with the company's growth narrative driven by the international expansion of BRIUMVI and ongoing trials. The positive economic environment has likely supported the stock's upward momentum, which could, in turn, positively impact revenue and earnings forecasts by enhancing investor sentiment and facilitating access to capital. Despite this short-term boost, it's important to consider that the long-term growth trajectory will depend heavily on successful execution of international expansion strategies and the outcome of ongoing clinical trials.

Over the past three years, TG Therapeutics's impressive total return, including dividends, reached a very large percentage, providing substantial context for the current market enthusiasm. Notably, the company outperformed the US Market, which saw an 11% return over the last year, as well as the US Biotechs industry, which returned -12.1%, marking TG Therapeutics as a standout performer on both fronts. Compared to these benchmarks, the company's longer-term performance adds significant weight to its growth narrative.

The price movement, in light of the analyst consensus price target of US$43.0, shows that TG Therapeutics's current share price is roughly in line with expectations, with only a small deviation indicating that the market sees the company as fairly valued at present. This alignment suggests that analysts' future expectations, particularly regarding revenue and earnings growth, are already factored into the current share price, underscoring the importance of delivering on those growth forecasts to maintain investor confidence.

Dive into the specifics of TG Therapeutics here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TG Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TGTX

TG Therapeutics

A commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives