- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Teradyne (TER) Reports Q2 Sales Drop And Provides Q3 Revenue Guidance

Reviewed by Simply Wall St

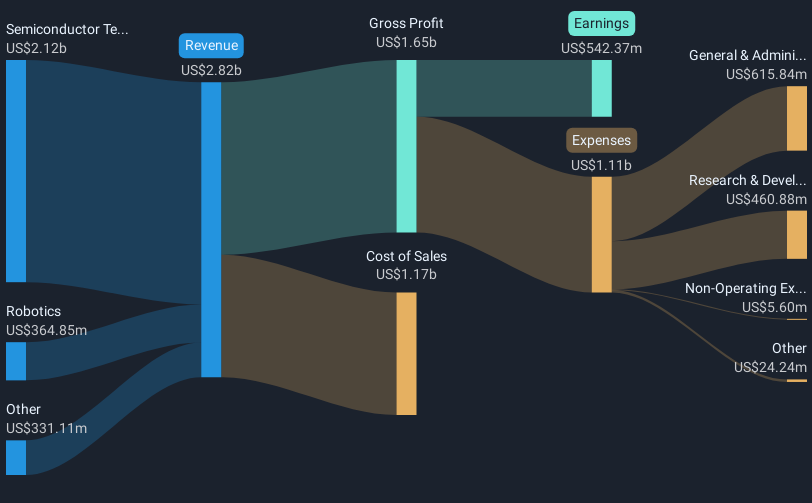

Teradyne (TER) reported a Q2 2025 decline in both sales and net income compared to the previous year, with earnings per share dropping significantly. Nonetheless, its stock price experienced a 22% increase this past quarter. The Q3 forecast suggests modest revenue and income improvement despite recent challenges. The company exited several Russell indices in June, potentially affecting market sentiment, whereas broader indices like the S&P 500 and Nasdaq showed strength, slightly up by 0.3% and 0.5%, respectively, amid favorable corporate earnings and easing tariff worries. Teradyne's increase might reflect alignment with positive market trends, including robust tech sector performance.

Buy, Hold or Sell Teradyne? View our complete analysis and fair value estimate and you decide.

Teradyne's recent financial report showing declines in sales and net income, yet a distinct 22% share price increase, lends an intriguing aspect to its transformation narrative. This share price movement aligns with broader indices, which experienced slight gains. The moderation in broader markets' tariffs and positive earnings results might have favorably influenced Teradyne's short-term market stature. While Teradyne's narrative emphasizes growth in AI, robotics, and semiconductor automation, the immediate response seems partially informed by such sector-wide optimism, despite operational challenges.

Examining Teradyne's longer-term performance reveals a modest total shareholder return of 3.24% over five years, highlighting its struggle to gain substantial momentum compared to its peers. The company's recent underperformance against the US Semiconductor industry, which returned 48.8% over the past year, suggests that it may be grappling with industry-specific challenges.

Looking forward, Teradyne's share buyback and AI focus could positively influence future revenue and earnings trajectories, as suggested by a slightly positive Q3 forecast. The nuances of its earnings assumptions reveal that to meet the analyst consensus price target of US$97.81, the company would need improved revenue and net profit margins. The current share price of US$90.55 reflects a discount to this target, suggesting restrained market enthusiasm yet acknowledging potential gains.

Review our growth performance report to gain insights into Teradyne's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives