- United States

- /

- Life Sciences

- /

- NasdaqGS:TEM

Tempus AI (TEM) Gains FDA Clearance for New Cardiovascular Risk Detection Software

Reviewed by Simply Wall St

Tempus AI (TEM) has recently secured FDA clearance for its Tempus ECG-Low EF software, an innovative AI-driven product aiding cardiovascular assessments. This development aligns with TEM’s aim to enhance its ECG-AI technology leadership, potentially strengthening its market position. Alongside, the company's improved Q1 earnings report, with notable revenue growth from $146 million to $256 million, reflects its robust performance. Additionally, Tempus’s expansion into new strategic partnerships, like the collaboration with Personalis to include colorectal cancer detection, further enhances its offerings. These positive advancements align with the wider market uptrend, contributing to TEM's 48% price increase over the last quarter.

We've discovered 3 warning signs for Tempus AI that you should be aware of before investing here.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

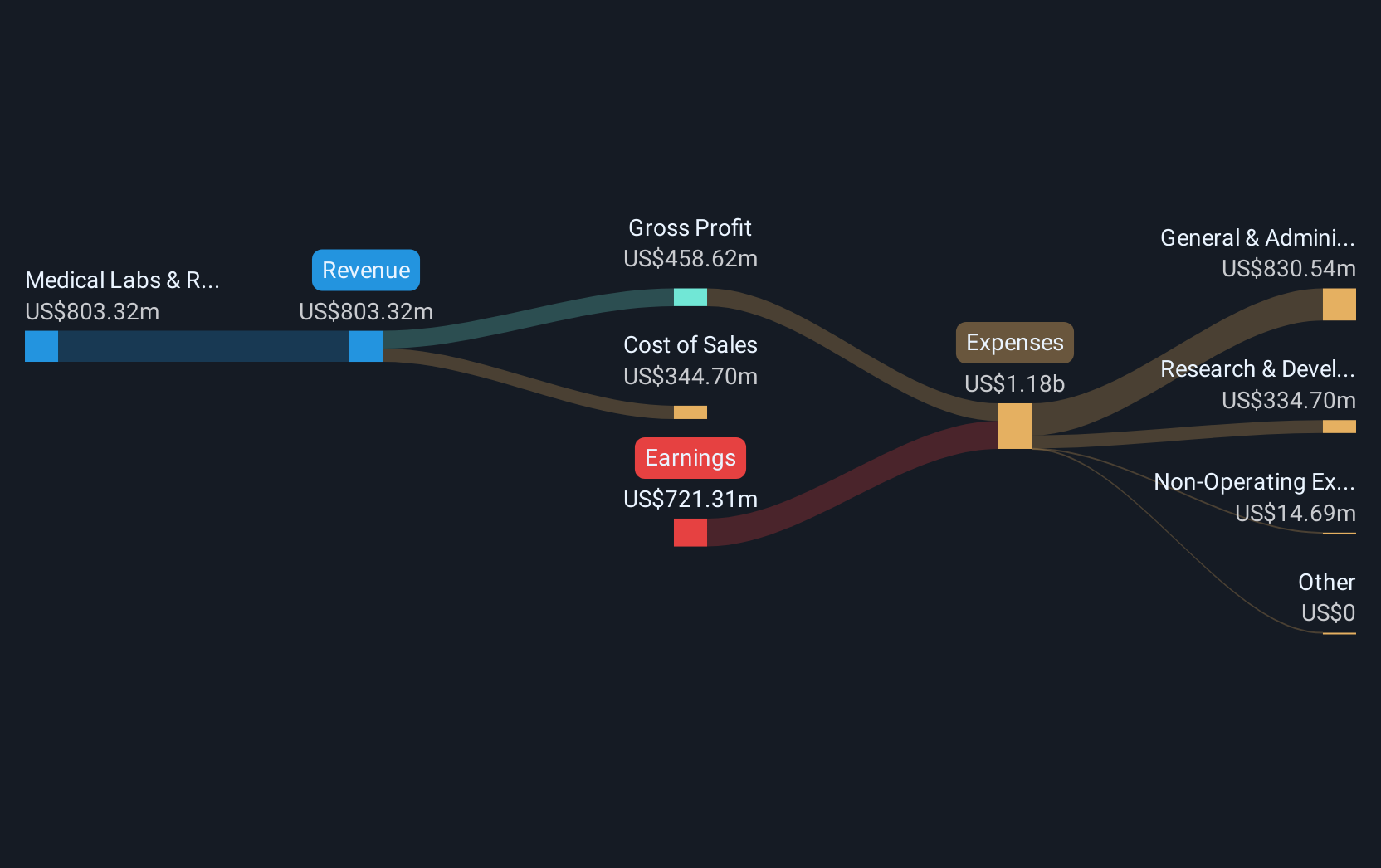

The recent FDA clearance for Tempus AI's ECG-Low EF software and partnerships such as the one with Personalis position the company to fortify its market presence within the AI-driven medical technology space. These developments could lead to substantial revenue enhancement, reflected in the company's Q1 revenue growth from US$146 million to US$256 million. This aligns with analyst expectations of Tempus AI's revenue growing at 22.7% annually, supported by large-scale agreements like the US$200 million data and modeling license deal with AstraZeneca and Pathos. However, while these innovations contribute to extensive revenue growth potential, Tempus AI remains unprofitable, with significant earnings anticipated to improve only with increased market share and cost efficiencies.

Over the last year, Tempus AI's total return, including share price appreciation and dividends, was 50.49%. This performance contrasts with the broader US Life Sciences industry, which saw a 23.3% decline during the same period, showcasing Tempus AI's robust market resilience. Despite this commendable growth, the current share price of US$59.97 is still below the consensus analyst price target of US$66.77, indicating a potential for further price appreciation. Notably, the share price growing 48% in the last quarter highlights investor confidence driven by these recent positive developments and long-term strategic direction.

Evaluate Tempus AI's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tempus AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEM

Moderate growth potential low.

Similar Companies

Market Insights

Community Narratives