TELUS (TSX:T) Increases Dividend 7% Amid CAD 285M Goodwill Impairment

Reviewed by Simply Wall St

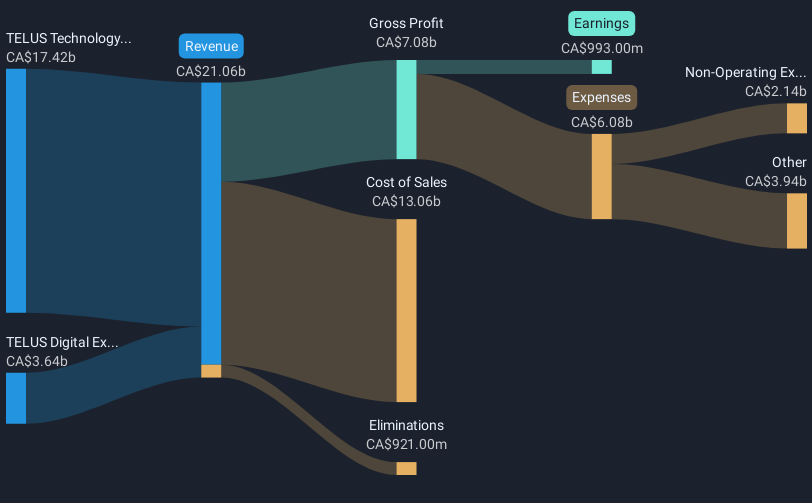

TELUS (TSX:T) recently announced a 7% increase in its quarterly dividend and disclosed a significant impairment of CAD 285 million, which coincided with the release of its second-quarter earnings showing a decline in net income to CAD 7 million from the previous year. These developments may have added weight to TELUS's 7.72% price move in the last quarter. Despite positive revenue growth, the broader market witnessed fluctuations, including sharp declines influenced by international tariffs and a weaker-than-expected U.S. jobs report. This complexity in market dynamics highlights how mixed company news can interact with external market pressures.

TELUS has 2 weaknesses we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TELUS's recent dividend increase and impairment announcement have potential implications for its revenue and earnings outlook. While the dividend uptick signals confidence in future cash flows, the CAD 285 million impairment might constrain short-term profitability. The share price's 7.72% quarterly movement reflects reactions to these mixed signals, amidst broader market volatility. Over the past five years, TELUS achieved a total return of 22.52%, providing a broader context for its somewhat stable growth trajectory.

Recent news impacts TELUS's revenue and earnings forecasts, as analysts anticipate gradual revenue growth and margin improvements. While the company faces competitive pressures, its diversification into health and agriculture might sustain revenue streams. However, with the current share price at CA$22.32 and the analyst price target at CA$23.34, the price difference suggests a limited upside potential in the near term, indicating that the stock is approaching its estimated fair value, according to consensus estimates.

In the last year, TELUS surpassed the Canadian Telecom industry's return of 13.9%, though it underperformed against the broader Canadian market's 17.0% return. This comparative performance underscores TELUS's resilience in a challenging market landscape, supported by its diversified business model and strategic investments aimed at long-term growth.

Understand TELUS' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives