TELUS (TSX:T) Expands Network with $2 Billion Investment in Ontario and Quebec

Reviewed by Simply Wall St

TELUS (TSX:T) recently congratulated Cogeco on launching its wireless network with TELUS as the wholesale provider, enhancing service offerings in Ontario and Quebec. Over the last quarter, TELUS's stock price rose 8.6%, during which time the company also announced a significant $2 billion investment into broadband services. This investment aligns with broader market trends as major indexes also saw gains, with the S&P 500 and Nasdaq hitting record highs. TELUS's strong market performance, infrastructure expansion, and strategic partnerships likely supported its positive share movement, adding additional weight to the sector's broader upward trends.

TELUS has 2 possible red flags we think you should know about.

The recent partnership between TELUS and Cogeco to enhance wireless services in Ontario and Quebec aligns well with TELUS's narrative of driving growth through customer expansion and diversification. This collaboration could potentially bolster TELUS's revenue by providing a more comprehensive service offering, particularly in regions where competition is intense. The enhancement of its service portfolio may increase customer satisfaction and reduce churn, supporting future earnings growth as forecasted by analysts.

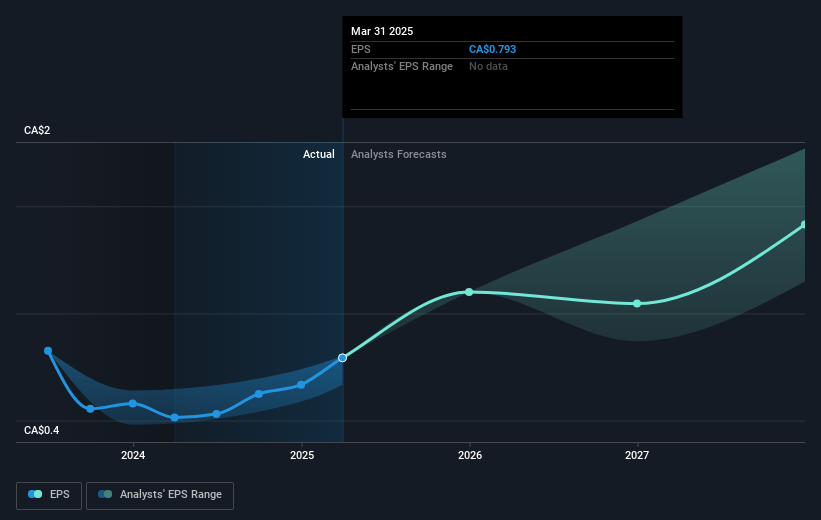

Over a five-year period, TELUS's total shareholder return, including dividends, was 27.23%. This performance provides context to the company's growth and returns strategy and demonstrates how dividends have been a significant component of shareholder value. While TELUS achieved a noteworthy growth in earnings over the past 12 months, outperforming the Canadian Telecom industry’s decline over the last year, its year-long performance still lagged behind the broader Canadian market, which returned 18.3%.

The CA$2 billion investment in broadband services should positively impact future revenue and earnings by expanding TELUS's infrastructure capabilities. However, competitive pressures and high debt levels pose risks. The current share price of CA$22.55 is close to the analyst consensus price target of CA$23.34, indicating that analysts perceive the stock to be fairly valued on average. Investors might want to assess TELUS’s ability to meet its ambitious growth and deleveraging targets to ascertain if the company's stock could reach or exceed its price target in the future.

Unlock comprehensive insights into our analysis of TELUS stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives