- United States

- /

- Machinery

- /

- NasdaqGM:SYM

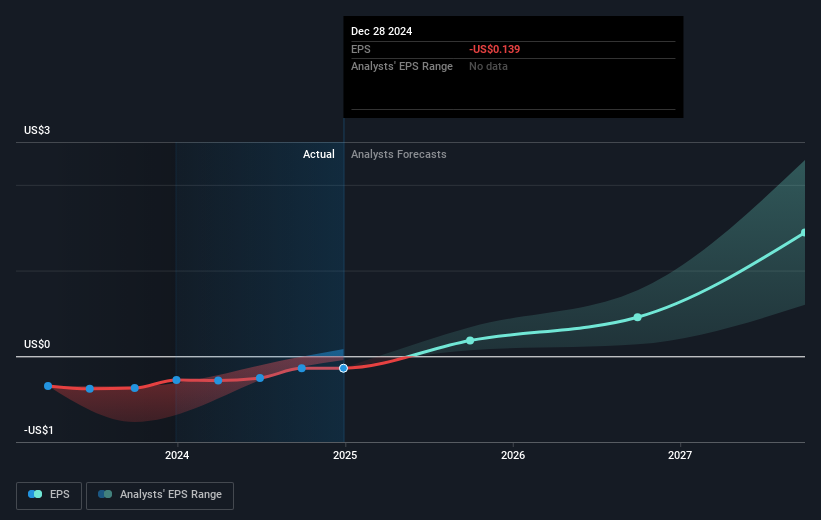

Symbotic (SYM) Reports Revenue Growth Despite US$6 Million Quarterly Net Loss

Reviewed by Simply Wall St

Symbotic (SYM) recently reported a striking 154% increase in share price over the last quarter, coinciding with significant company developments. The company's announcement of an innovative next-generation storage technology aimed at enhancing warehouse automation could have attracted investor interest. Additionally, the release of earnings for the third quarter, highlighting substantial revenue growth amidst broader economic concerns such as tariffs, may have instilled further confidence. The market's broader upward trajectory, buoyed by robust performance from technology giants and strong overall market sentiment, likely supported Symbotic’s impressive price movement within the context of these strategic developments.

The recent surge in Symbotic's share price, fueled by advancements in storage technology and revealing earnings, has generated excitement amid an uncertain economic backdrop. While the market uplifted by tech giant successes has certainly benefited Symbotic, the broader picture of a substantial 283.77% total shareholder return over the past three years showcases the company's longer-term transformation in value. This significant growth compares favorably against the US Machinery industry's 22.1% increase over the past year, suggesting Symbotic's impressive trajectory in a challenging market.

The company's innovative strategies, including the Walmart Robotics acquisition and the focus on retail automation, suggest potential revenue and earnings enhancement through expanded technology platforms. However, execution risks and integration complexities highlight the need for careful management to realize anticipated synergies. Current share price evaluations reveal a valuation above the consensus analyst price target of US$39.07, indicating market optimism but possibly a disconnect with consensus expectations which rely on strong future earnings growth and improved margins.

The valuation report we've compiled suggests that Symbotic's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives