- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:DAKT

Such Is Life: How Daktronics (NASDAQ:DAKT) Shareholders Saw Their Shares Drop 58%

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Daktronics, Inc. (NASDAQ:DAKT), since the last five years saw the share price fall 58%. And some of the more recent buyers are probably worried, too, with the stock falling 41% in the last year. Even worse, it's down 28% in about a month, which isn't fun at all. But this could be related to poor market conditions -- stocks are down 30% in the same time.

See our latest analysis for Daktronics

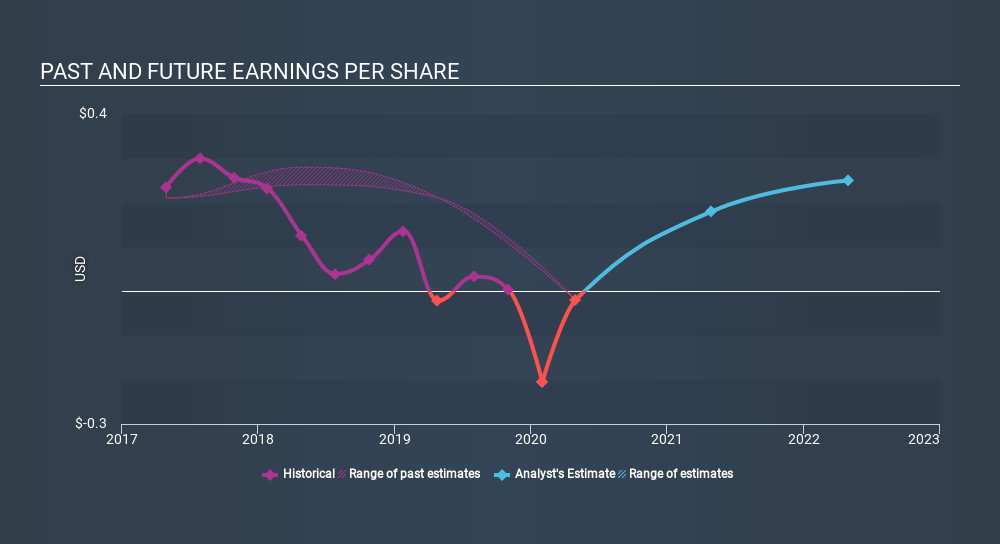

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over five years Daktronics's earnings per share dropped significantly, falling to a loss, with the share price also lower. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Daktronics's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Daktronics's TSR for the last 5 years was -49%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 14% in the twelve months, Daktronics shareholders did even worse, losing 39% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Daktronics , and understanding them should be part of your investment process.

Daktronics is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:DAKT

Daktronics

Designs, manufactures, and sells electronic scoreboards, programmable display systems and large screen video displays for sporting, commercial, and transportation applications in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives