Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGS:AXTI

Little Excitement Around AXT, Inc.'s (NASDAQ:AXTI) Revenues As Shares Take 34% Pounding

The AXT, Inc. (NASDAQ:AXTI) share price has softened a substantial 34% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

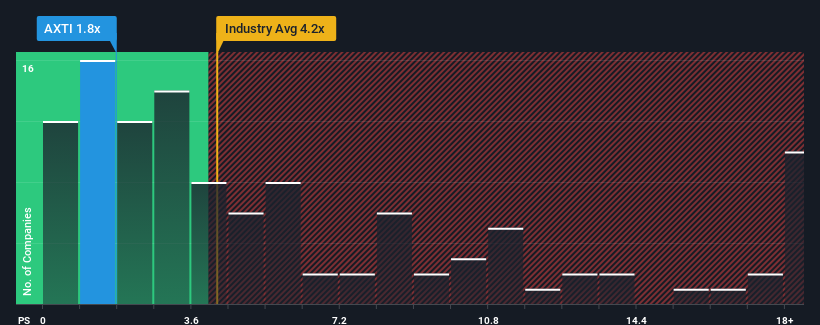

Since its price has dipped substantially, AXT may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.8x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 4.2x and even P/S higher than 11x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for AXT

What Does AXT's Recent Performance Look Like?

While the industry has experienced revenue growth lately, AXT's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on AXT will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For AXT?

AXT's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 21% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 23% as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 45% growth forecast for the broader industry.

In light of this, it's understandable that AXT's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

AXT's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of AXT's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for AXT that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether AXT is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AXTI

AXT

AXT, Inc. designs, develops, manufactures, and distributes compound and single element semiconductor substrates.

High growth potential with mediocre balance sheet.