Stock Analysis

- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:GRPN

Even though Groupon (NASDAQ:GRPN) has lost US$59m market cap in last 7 days, shareholders are still up 182% over 1 year

The Groupon, Inc. (NASDAQ:GRPN) share price is down a rather concerning 41% in the last month. But that doesn't detract from the splendid returns of the last year. Indeed, the share price is up an impressive 182% in that time. So we think most shareholders won't be too upset about the recent fall. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Although Groupon has shed US$59m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Groupon

Because Groupon made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Groupon saw its revenue shrink by 14%. We're a little surprised to see the share price pop 182% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

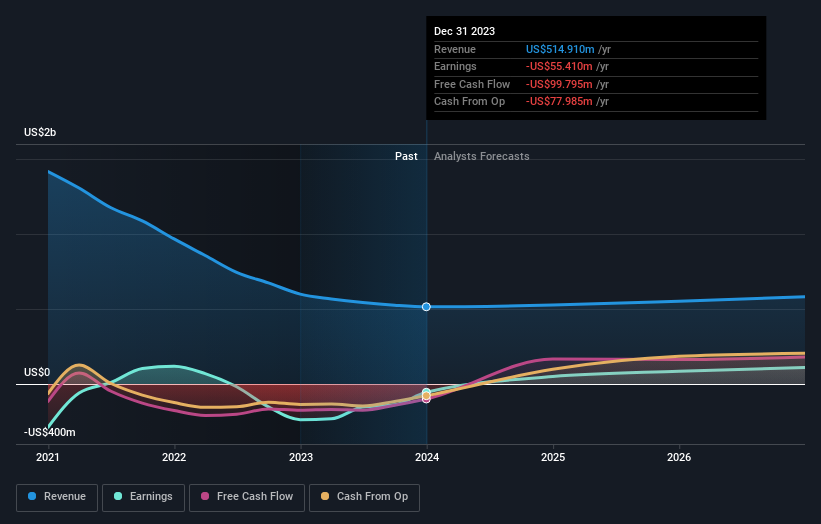

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Groupon in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Groupon has rewarded shareholders with a total shareholder return of 182% in the last twelve months. That certainly beats the loss of about 13% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Groupon has 3 warning signs we think you should be aware of.

Of course Groupon may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Groupon is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GRPN

Groupon

Groupon, Inc., together with its subsidiaries, operates a marketplace that connects consumers to merchants.

Undervalued with moderate growth potential.