Stock Analysis

- United Kingdom

- /

- Metals and Mining

- /

- LSE:FRES

Subdued Growth No Barrier To Fresnillo plc (LON:FRES) With Shares Advancing 30%

Fresnillo plc (LON:FRES) shareholders have had their patience rewarded with a 30% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

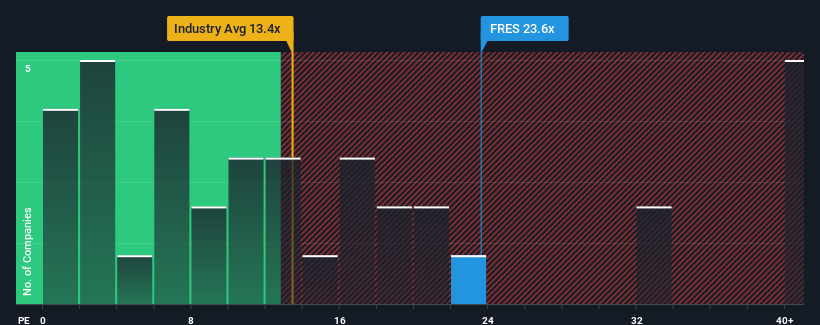

Since its price has surged higher, Fresnillo's price-to-earnings (or "P/E") ratio of 23.6x might make it look like a strong sell right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios below 15x and even P/E's below 9x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Fresnillo has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Fresnillo

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Fresnillo's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 37% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 19% per year as estimated by the ten analysts watching the company. Meanwhile, the broader market is forecast to expand by 14% per year, which paints a poor picture.

In light of this, it's alarming that Fresnillo's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Fresnillo's P/E?

Shares in Fresnillo have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Fresnillo currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about this 1 warning sign we've spotted with Fresnillo.

If you're unsure about the strength of Fresnillo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Fresnillo is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About LSE:FRES

Fresnillo

Fresnillo plc mines, develops, and produces non-ferrous minerals in Mexico.

Flawless balance sheet with poor track record.