As we head into the second half of 2025, the Canadian market is closely monitoring developments in trade negotiations, particularly between the U.S. and China, which could impact economic growth and inflation. In such a climate, identifying stocks with strong financials becomes crucial for investors seeking stability amidst uncertainty. Penny stocks, despite their somewhat outdated name, continue to offer intriguing opportunities; when backed by robust fundamentals, they can provide significant value and potential growth for those willing to explore smaller or newer companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.69 | CA$631.17M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.34 | CA$743.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.53 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$538.89M | ✅ 3 ⚠️ 2 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.18 | CA$94.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.14 | CA$121.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.95 | CA$152.77M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.90 | CA$186.9M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.88 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 883 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Stock Trend Capital (CNSX:PUMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stock Trend Capital Inc. is an investment company concentrating on the Canadian cannabis and artificial intelligence industries, with a market cap of CA$6.60 million.

Operations: The company's revenue segment includes Corporate and Development, which reported -CA$0.65 million.

Market Cap: CA$6.6M

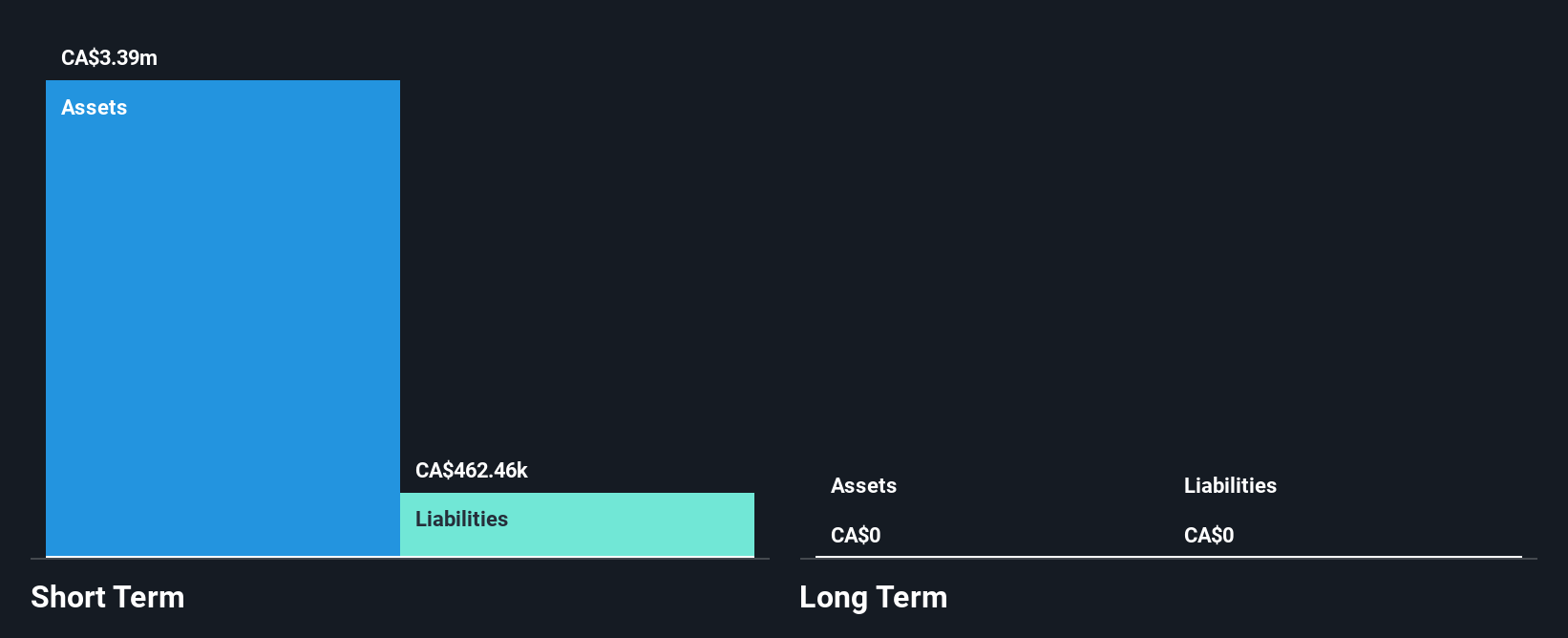

Stock Trend Capital Inc., focusing on cannabis and AI, has recently transitioned to profitability despite being pre-revenue with negative CA$0.65 million reported. The company achieved a net income of CA$1.07 million for the third quarter, a significant turnaround from last year's losses. With no debt and short-term assets of CA$3.4 million exceeding liabilities, financial stability is evident despite high share price volatility (108% weekly). The management team averages 2.3 years in tenure, adding experience to its operations. However, revenue remains under US$1 million, indicating early-stage business development challenges amidst profit growth.

- Dive into the specifics of Stock Trend Capital here with our thorough balance sheet health report.

- Assess Stock Trend Capital's previous results with our detailed historical performance reports.

Nubeva Technologies (TSXV:NBVA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nubeva Technologies Ltd. develops and licenses software-based decryption solutions, including Ransomware Reversal, with a market cap of CA$8.42 million.

Operations: The company generates revenue of $0.64 million from its software development and commercialization activities.

Market Cap: CA$8.42M

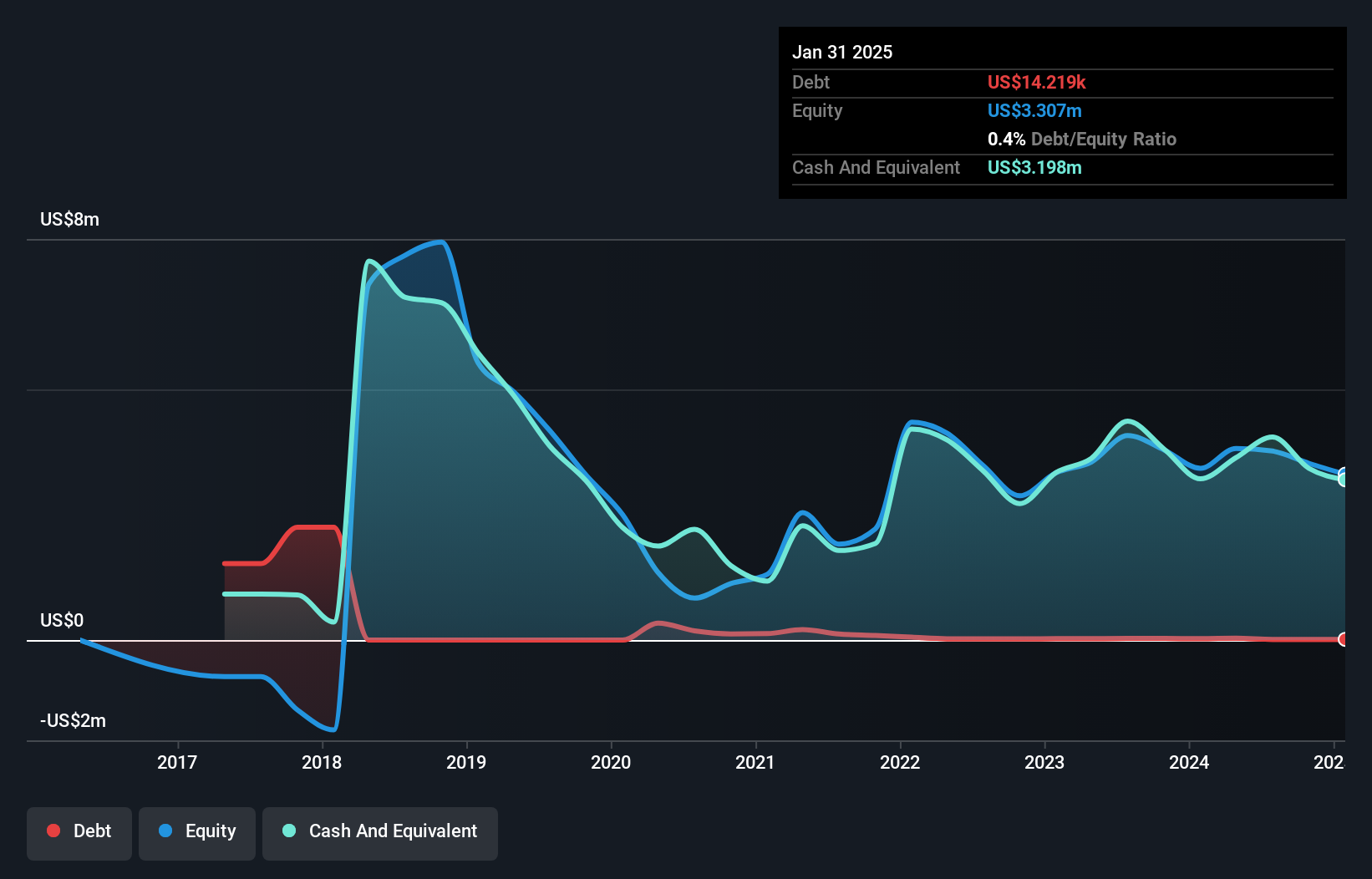

Nubeva Technologies Ltd. operates in the software sector, generating a modest revenue of US$0.64 million, thus classifying it as pre-revenue. Despite this, the company has recently achieved profitability with earnings growth over the past year, albeit impacted by a significant one-off gain of US$1 million. The company's financial position is bolstered by short-term assets of US$3.5 million exceeding both short and long-term liabilities and having more cash than total debt. However, its share price remains highly volatile compared to most Canadian stocks, reflecting potential risks for investors seeking stability in their portfolios.

- Unlock comprehensive insights into our analysis of Nubeva Technologies stock in this financial health report.

- Learn about Nubeva Technologies' historical performance here.

Star Royalties (TSXV:STRR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Star Royalties Ltd. is a company engaged in precious metals and decarbonization solutions through royalty and streaming operations, with a market cap of CA$18.48 million.

Operations: The company's revenue is derived from the acquisition of royalty interests, totaling $0.70 million.

Market Cap: CA$18.48M

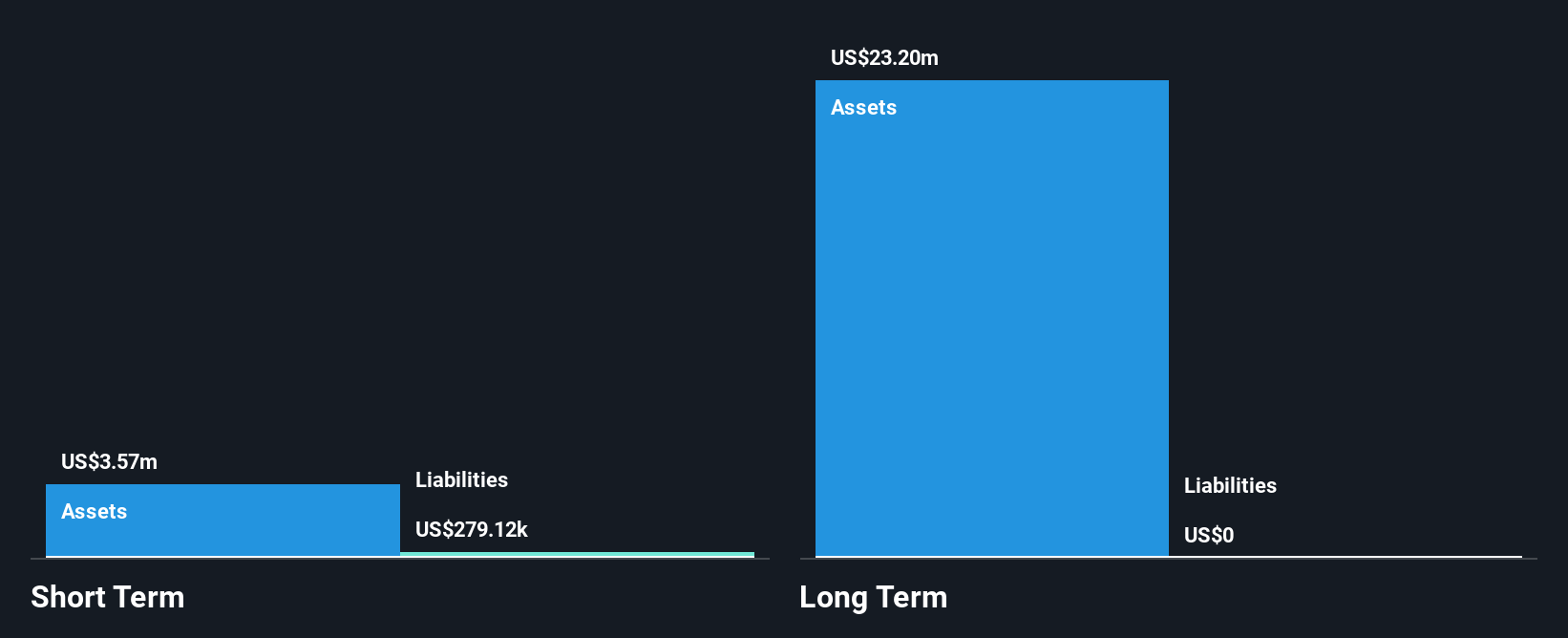

Star Royalties Ltd., with a market cap of CA$18.48 million, is pre-revenue, generating less than US$1 million annually. The company reported a net loss of US$24.09 million for 2024 and continues to face profitability challenges, with earnings declining by 22% annually over the past five years. Despite its unprofitability and negative return on equity, Star Royalties benefits from an experienced management team and board of directors with average tenures exceeding industry norms. The company's financial stability is supported by short-term assets significantly surpassing short-term liabilities, while being debt-free eliminates concerns about interest payments or long-term liabilities.

- Jump into the full analysis health report here for a deeper understanding of Star Royalties.

- Examine Star Royalties' past performance report to understand how it has performed in prior years.

Next Steps

- Click this link to deep-dive into the 883 companies within our TSX Penny Stocks screener.

- Seeking Other Investments? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nubeva Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NBVA

Nubeva Technologies

Engages in the development and licensing of software-based decryption solutions, including Ransomware Reversal.

Adequate balance sheet slight.

Market Insights

Community Narratives