- India

- /

- Auto Components

- /

- NSEI:STERTOOLS

Sterling Tools Limited (NSE:STERTOOLS) Investors Should Think About This Before Buying It For Its Dividend

Today we'll take a closer look at Sterling Tools Limited (NSE:STERTOOLS) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

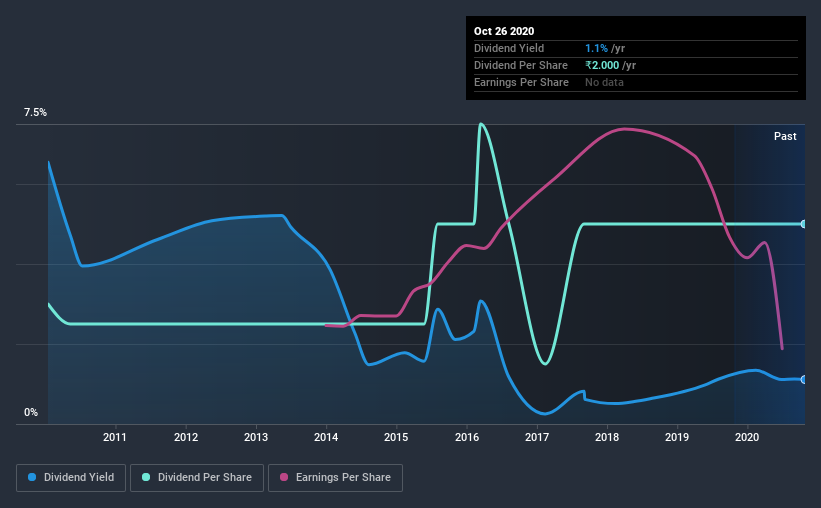

While Sterling Tools's 1.1% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Sterling Tools!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Sterling Tools paid out 57% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Sterling Tools paid out 119% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Sterling Tools paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough free cash flow to cover the dividend. Cash is king, as they say, and were Sterling Tools to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Remember, you can always get a snapshot of Sterling Tools' latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Sterling Tools has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was ₹1.2 in 2010, compared to ₹2.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 5.2% a year over that time. The dividends haven't grown at precisely 5.2% every year, but this is a useful way to average out the historical rate of growth.

It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Sterling Tools might have put its house in order since then, but we remain cautious.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Sterling Tools' EPS have fallen by approximately 11% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

To summarise, shareholders should always check that Sterling Tools' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. First, we think Sterling Tools has an acceptable payout ratio, although its dividend was not well covered by cashflow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. In this analysis, Sterling Tools doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for Sterling Tools that investors need to be conscious of moving forward.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade Sterling Tools, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:STERTOOLS

Sterling Tools

Manufactures and sells high tensile cold forged fasteners to original equipment manufacturers in India.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion