Some Velocity Property Group (ASX:VP7) Shareholders Have Taken A Painful 92% Share Price Drop

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Velocity Property Group Limited (ASX:VP7), who have seen the share price tank a massive 92% over a three year period. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 48% in a year. Furthermore, it's down 51% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 22% decline in the broader market, throughout the period.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Velocity Property Group

Velocity Property Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Velocity Property Group grew revenue at 40% per year. That's well above most other pre-profit companies. So why has the share priced crashed 57% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

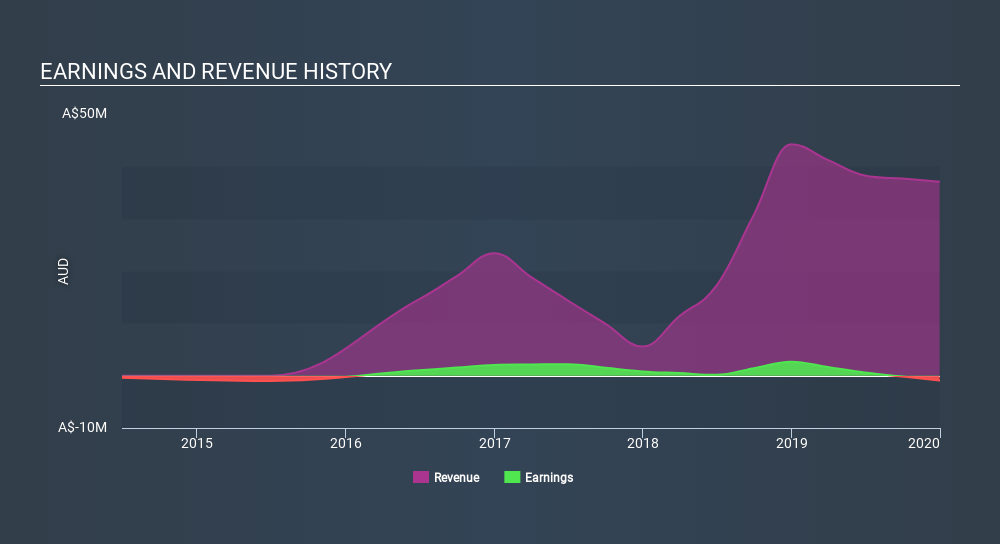

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

The last twelve months weren't great for Velocity Property Group shares, which performed worse than the market, costing holders 48%. The market shed around 11%, no doubt weighing on the stock price. However, the loss over the last year isn't as bad as the 57% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Velocity Property Group (including 4 which is can't be ignored) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Market Insights

Community Narratives