- United States

- /

- Medical Equipment

- /

- NasdaqCM:SSKN

Some STRATA Skin Sciences (NASDAQ:SSKN) Shareholders Have Taken A Painful 82% Share Price Drop

STRATA Skin Sciences, Inc. (NASDAQ:SSKN) shareholders are doubtless heartened to see the share price bounce 66% in just one week. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 82% in that time. The recent bounce might mean the long decline is over, but we are not confident. The fundamental business performance will ultimately determine if the turnaround can be sustained.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for STRATA Skin Sciences

STRATA Skin Sciences isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, STRATA Skin Sciences saw its revenue increase by 22% per year. That's well above most other pre-profit companies. So it's not at all clear to us why the share price sunk 29% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

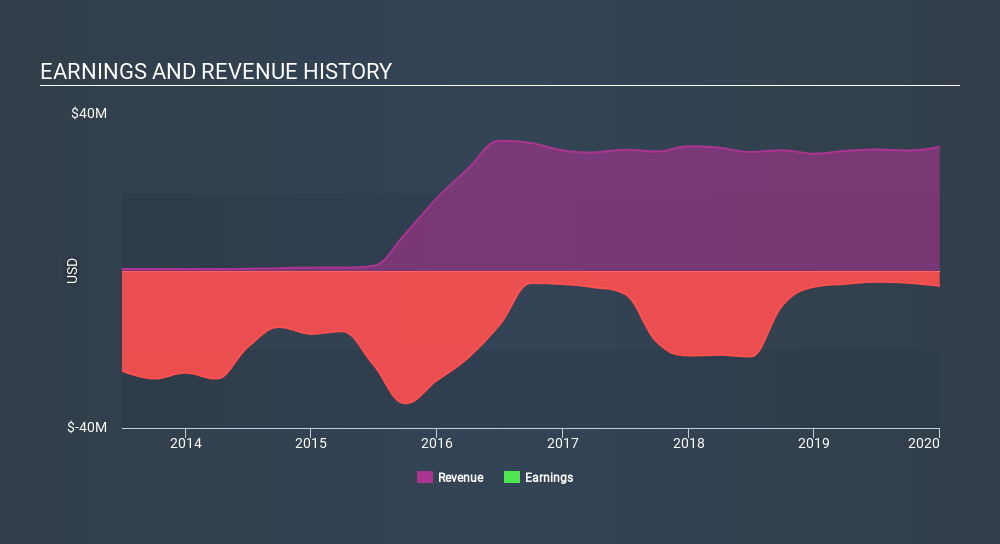

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 3.2% in the twelve months, STRATA Skin Sciences shareholders did even worse, losing 44%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 29% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for STRATA Skin Sciences you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:SSKN

STRATA Skin Sciences

A medical technology company, develops, commercializes, and markets products for the treatment of dermatologic conditions in the United States, China, Europe, the Middle East, Asia, Australia, South Africa, and Central and South America.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives