- Canada

- /

- Energy Services

- /

- TSX:MCB

Some McCoy Global (TSE:MCB) Shareholders Have Taken A Painful 85% Share Price Drop

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. Imagine if you held McCoy Global Inc. (TSE:MCB) for half a decade as the share price tanked 85%. And it's not just long term holders hurting, because the stock is down 48% in the last year. On top of that, the share price is down 16% in the last week.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for McCoy Global

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, McCoy Global moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

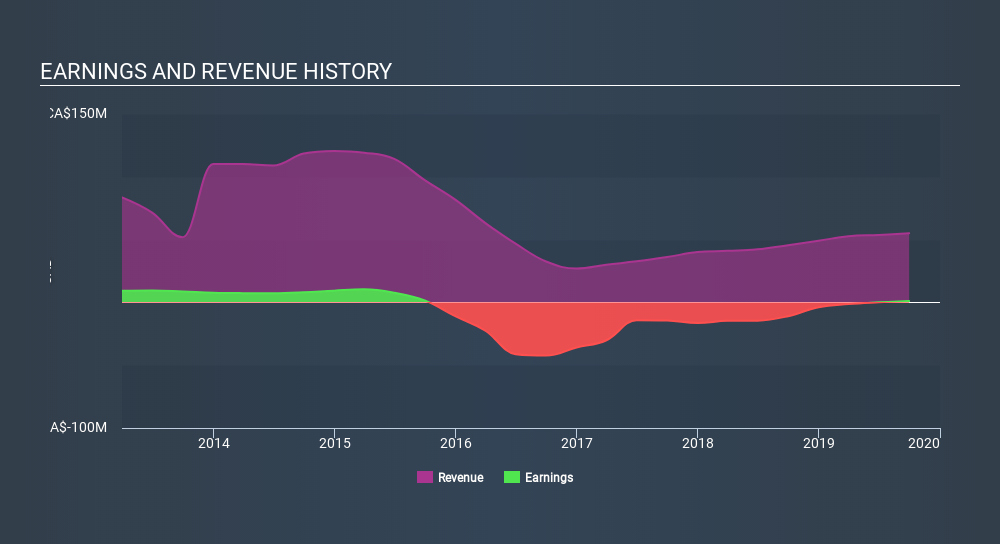

Arguably, the revenue drop of 24% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how McCoy Global has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at McCoy Global's financial health with this free report on its balance sheet.

A Different Perspective

Investors in McCoy Global had a tough year, with a total loss of 48%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 31% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand McCoy Global better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with McCoy Global , and understanding them should be part of your investment process.

We will like McCoy Global better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:MCB

McCoy Global

Provides equipment and technologies designed to support tubular running operations that enhance wellbore integrity and assist with collecting data for the energy industry in the United States, Latin America, the Middle East, Africa, Europe, the Asia Pacific, and Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives