- United States

- /

- Software

- /

- NYSE:CRM

Skillsoft Teams Up With Salesforce (NYSE:CRM) To Elevate AI-Powered Customer Support And Engagement

Reviewed by Simply Wall St

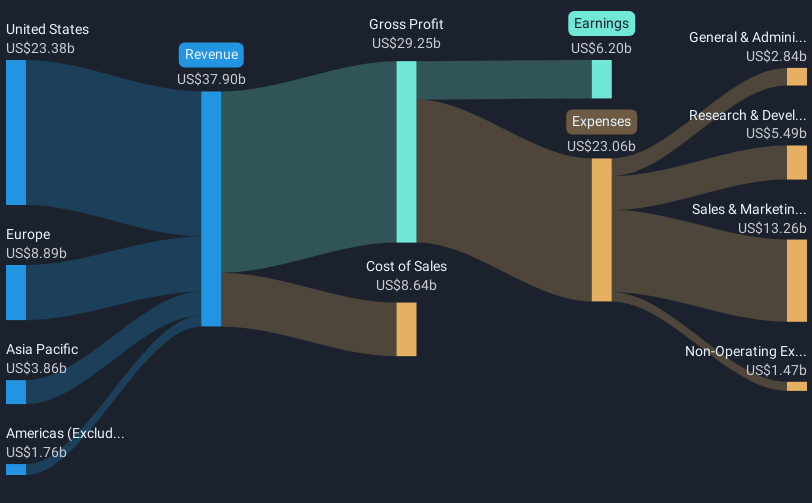

Salesforce (NYSE:CRM) recently announced a collaboration with Skillsoft to integrate AI-powered upskilling into its platform, aligning with news that the Indiana Fever is implementing Salesforce's Agentforce to enhance fan engagement. These developments underscore Salesforce's commitment to innovation in workforce management and customer engagement. However, these initiatives coincided with a market environment where indexes, including the S&P 500 and Nasdaq, reached their highest levels since February due to benign inflation data and positive trade talk developments. Salesforce's 1.42% price move over the past week reflects alignment with broader market trends.

Salesforce has 1 risk we think you should know about.

Salesforce's recent collaboration with Skillsoft and efforts with the Indiana Fever highlight its commitment to innovation, integrating AI-powered solutions across various domains. This move could potentially accelerate Salesforce's expansion into AI and data solutions, driving revenue growth and benefiting from AI uptake across different industries. By infusing AI into workforce management and customer engagement, Salesforce might see enhanced operational efficiencies, potentially impacting future earnings positively.

Over the longer term, Salesforce's total shareholder return was 64.27% in the last three years, reflecting significant growth despite recent fluctuations. In contrast, the company's one-year performance lagged behind the US Software industry, which saw a 21% return, and the broader US market with a 12.8% return.

The recent partnerships and product integrations may influence revenue projections and future earnings growth, supporting Salesforce's transition to consumption-based pricing models. However, with a current share price of US$273.36 against an analyst consensus price target of US$364.65, there remains a 25% discount, suggesting potential upside if the company meets projected forecasts. This anticipated growth aligns with analysts' expectations but requires careful consideration of evolving market dynamics and product success.

Understand Salesforce's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives