Should You Worry About RPMGlobal Holdings Limited's (ASX:RUL) CEO Salary Level?

Richard Mathews has been the CEO of RPMGlobal Holdings Limited (ASX:RUL) since 2012. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

View our latest analysis for RPMGlobal Holdings

How Does Richard Mathews's Compensation Compare With Similar Sized Companies?

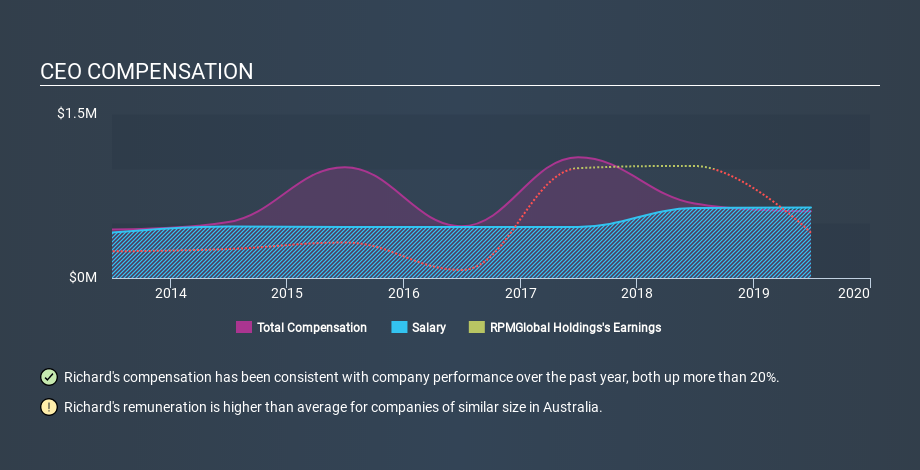

According to our data, RPMGlobal Holdings Limited has a market capitalization of AU$230m, and paid its CEO total annual compensation worth AU$610k over the year to June 2019. Notably, the salary of AU$644k is the vast majority of the CEO compensation. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of AU$146m to AU$583m. The median total CEO compensation was AU$761k.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. Speaking on an industry level, we can see that nearly 67% of total compensation represents salary, while the remainder of 33% is other remuneration. It's interesting to note that RPMGlobal Holdings pays out a greater portion of remuneration through salary, in comparison to the wider industry.

So Richard Mathews receives a similar amount to the median CEO pay, amongst the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance. You can see, below, how CEO compensation at RPMGlobal Holdings has changed over time.

Is RPMGlobal Holdings Limited Growing?

On average over the last three years, RPMGlobal Holdings Limited has seen earnings per share (EPS) move in a favourable direction by 5.1% each year (using a line of best fit). In the last year, its revenue is up 7.4%.

I'd prefer higher revenue growth, but the modest improvement in EPS is good. Considering these factors I'd say performance has been pretty decent, though not amazing. Shareholders might be interested in this free visualization of analyst forecasts.

Has RPMGlobal Holdings Limited Been A Good Investment?

I think that the total shareholder return of 82%, over three years, would leave most RPMGlobal Holdings Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Remuneration for Richard Mathews is close enough to the median pay for a CEO of a similar sized company .

The company isn't showing particularly great growth, but shareholder returns have been pleasing. So we can conclude that on this analysis the CEO compensation seems pretty sound. Moving away from CEO compensation for the moment, we've identified 2 warning signs for RPMGlobal Holdings that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives