Should You Worry About James Cropper PLC's (LON:CRPR) CEO Pay?

In 2012, Phil Wild was appointed CEO of James Cropper PLC (LON:CRPR). This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for James Cropper

How Does Phil Wild's Compensation Compare With Similar Sized Companies?

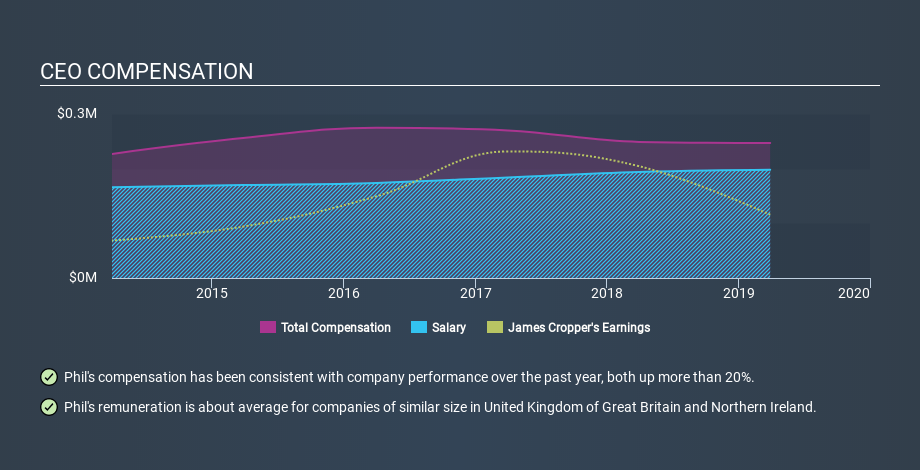

According to our data, James Cropper PLC has a market capitalization of UK£105m, and paid its CEO total annual compensation worth UK£247k over the year to March 2019. While we always look at total compensation first, we note that the salary component is less, at UK£198k. We took a group of companies with market capitalizations below UK£159m, and calculated the median CEO total compensation to be UK£272k.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. Talking in terms of the sector, salary represented approximately 63% of total compensation out of all the companies we analysed, while other remuneration made up 37% of the pie. So it seems like there isn't a significant difference between James Cropper and the broader market, in terms of salary allocation in the overall compensation package.

That means Phil Wild receives fairly typical remuneration for the CEO of a company that size. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance. You can see a visual representation of the CEO compensation at James Cropper, below.

Is James Cropper PLC Growing?

On average over the last three years, James Cropper PLC has shrunk earnings per share by 22% each year (measured with a line of best fit). In the last year, its revenue is up 4.7%.

Unfortunately, earnings per share have trended lower over the last three years. The fairly low revenue growth fails to impress given that the earnings per share is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. You might want to check this free visual report on analyst forecasts for future earnings.

Has James Cropper PLC Been A Good Investment?

With a three year total loss of 24%, James Cropper PLC would certainly have some dissatisfied shareholders. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Phil Wild is paid around what is normal for the leaders of comparable size companies.

The company isn't growing EPS, and shareholder returns have been disappointing. Most would consider it prudent for the company to hold off any CEO pay rise until performance improves. On another note, we've spotted 3 warning signs for James Cropper that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About AIM:CRPR

James Cropper

Manufactures and sells paper products and advanced materials.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.