- United States

- /

- Communications

- /

- NasdaqGS:AUDC

Should You Rely On AudioCodes's (NASDAQ:AUDC) Earnings Growth?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding AudioCodes (NASDAQ:AUDC).

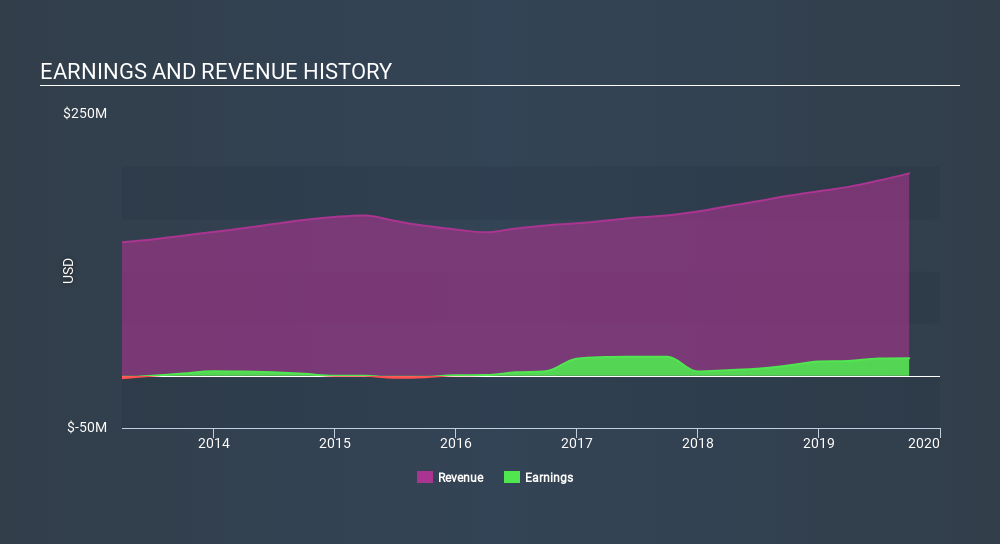

While AudioCodes was able to generate revenue of US$193.3m in the last twelve months, we think its profit result of US$16.7m was more important. In the chart below, you can see that its profit and revenue have both grown over the last three years.

See our latest analysis for AudioCodes

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. So today we'll look at what AudioCodes's cashflow tells us about the quality of its earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Zooming In On AudioCodes's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to September 2019, AudioCodes recorded an accrual ratio of -0.35. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of US$30m, well over the US$16.7m it reported in profit. AudioCodes's free cash flow improved over the last year, which is generally good to see.

Our Take On AudioCodes's Profit Performance

As we discussed above, AudioCodes's accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Because of this, we think AudioCodes's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And on top of that, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Ultimately, this article has formed an opinion based on historical data. However, it can also be great to think about what analysts are forecasting for the future. So feel free to check out our free graph representing analyst forecasts.

Today we've zoomed in on a single data point to better understand the nature of AudioCodes's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:AUDC

AudioCodes

Provides advanced communications software, products, and productivity solutions for the digital workplace worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives