- United States

- /

- Trade Distributors

- /

- NYSE:WSO

Should You Consider Watsco, Inc. (NYSE:WSO)?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

I've been keeping an eye on Watsco, Inc. (NYSE:WSO) because I'm attracted to its fundamentals. Looking at the company as a whole, as a potential stock investment, I believe WSO has a lot to offer. Basically, it is a financially-robust , dividend-paying company with a strong history of performance. Below, I've touched on some key aspects you should know on a high level. If you're interested in understanding beyond my broad commentary, read the full report on Watsco here.

Flawless balance sheet with proven track record and pays a dividend

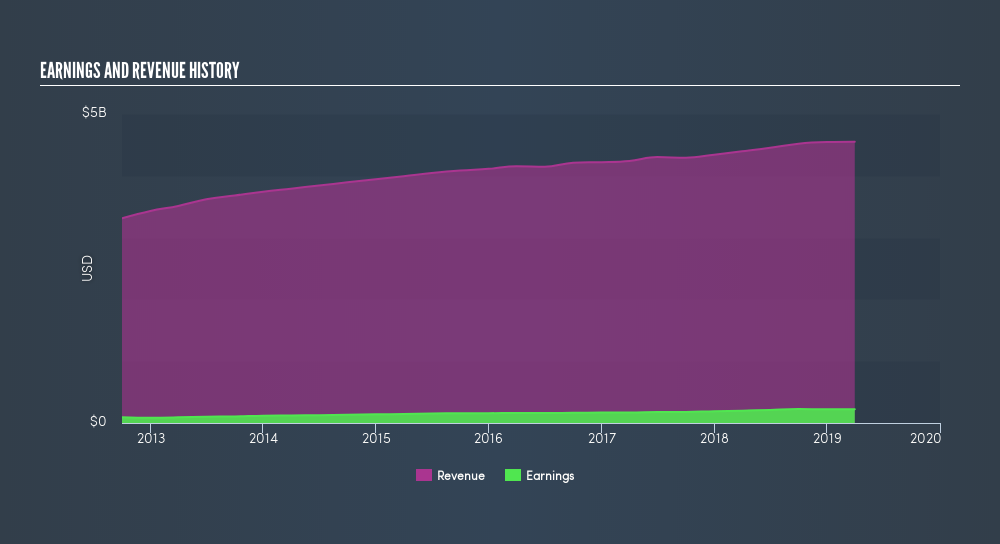

Over the past year, WSO has grown its earnings by 12%, with its most recent figure exceeding its annual average over the past five years. Not only did WSO outperformed its past performance, its growth also surpassed the Trade Distributors industry expansion, which generated a -7.0% earnings growth. This is an optimistic signal for the future. WSO's strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This indicates that WSO has sufficient cash flows and proper cash management in place, which is a crucial insight into the health of the company. WSO appears to have made good use of debt, producing operating cash levels of 1.86x total debt in the prior year. This is a strong indication that debt is reasonably met with cash generated.

WSO’s reputation for being one of the best dividend payers in the market is supported by the fact that it has been steadily growing its dividend payments over the past ten years and currently is one of the top yielding companies on the markets, at 3.9%.

Next Steps:

For Watsco, I've put together three essential factors you should further research:

- Future Outlook: What are well-informed industry analysts predicting for WSO’s future growth? Take a look at our free research report of analyst consensus for WSO’s outlook.

- Valuation: What is WSO worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether WSO is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of WSO? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:WSO

Watsco

Engages in the distribution of air conditioning, heating, and refrigeration equipment, and related parts and supplies in the United States, Canada, Latin America, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Perion (PERI) Q4 Earnings: Real AI Turnaround… or Just Another Adtech Hype Cycle? 🤔📊

TSMC will drive future growth with CoWoS packaging and N2 rollout

Beyond 2026, Beyond a Double

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.

Nedbank please contact me,l need guidance step by step, please