- United States

- /

- Insurance

- /

- NYSE:MMC

Should You Be Worried About Insider Transactions At Marsh & McLennan Companies, Inc. (NYSE:MMC)?

It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Marsh & McLennan Companies, Inc. (NYSE:MMC).

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.

View our latest analysis for Marsh & McLennan Companies

Marsh & McLennan Companies Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the insider, Peter Hearn, for US$835k worth of shares, at about US$107 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of US$111. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 44% of Peter Hearn's stake.

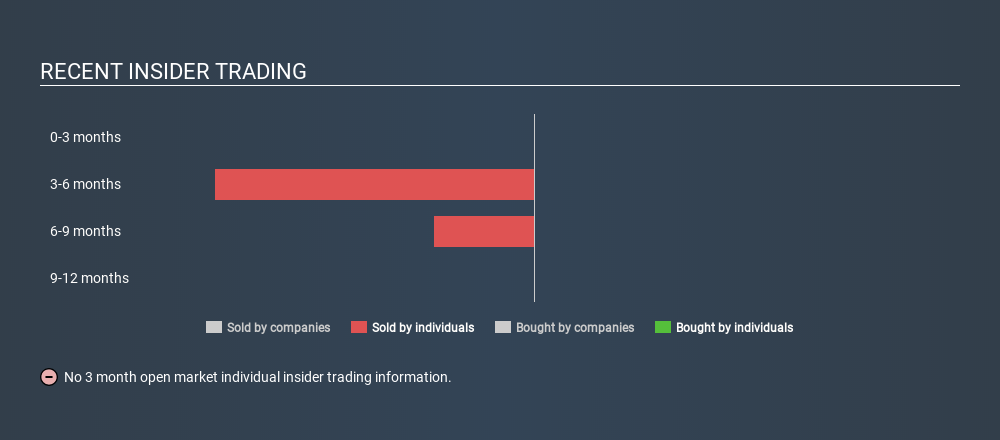

Marsh & McLennan Companies insiders didn't buy any shares over the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Marsh & McLennan Companies

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It's great to see that Marsh & McLennan Companies insiders own 0.2% of the company, worth about US$119m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Marsh & McLennan Companies Tell Us?

It doesn't really mean much that no insider has traded Marsh & McLennan Companies shares in the last quarter. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Marsh & McLennan Companies insider transactions don't fill us with confidence. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Marsh & McLennan Companies. To that end, you should learn about the 2 warning signs we've spotted with Marsh & McLennan Companies (including 1 which is potentially serious).

Of course Marsh & McLennan Companies may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NYSE:MMC

Marsh & McLennan Companies

A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion