- Hong Kong

- /

- Entertainment

- /

- SEHK:1119

Should You Be Tempted To Sell iDreamSky Technology Holdings Limited (HKG:1119) Because Of Its P/E Ratio?

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. We'll show how you can use iDreamSky Technology Holdings Limited's (HKG:1119) P/E ratio to inform your assessment of the investment opportunity. iDreamSky Technology Holdings has a price to earnings ratio of 16.95, based on the last twelve months. In other words, at today's prices, investors are paying HK$16.95 for every HK$1 in prior year profit.

Check out our latest analysis for iDreamSky Technology Holdings

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share (in the reporting currency) ÷ Earnings per Share (EPS)

Or for iDreamSky Technology Holdings:

P/E of 16.95 = CNY4.82 (Note: this is the share price in the reporting currency, namely, CNY ) ÷ CNY0.28 (Based on the year to June 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Does iDreamSky Technology Holdings's P/E Ratio Compare To Its Peers?

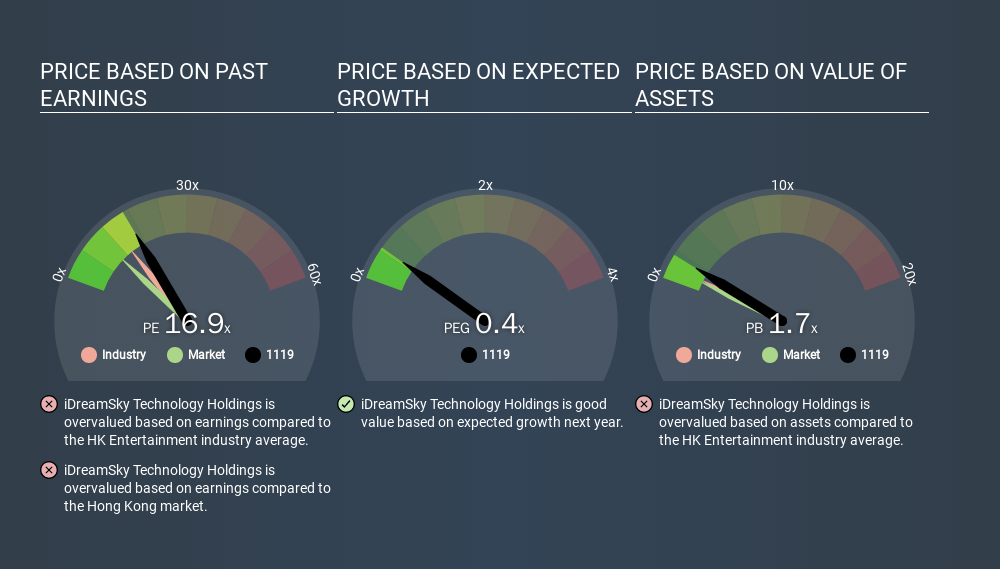

We can get an indication of market expectations by looking at the P/E ratio. The image below shows that iDreamSky Technology Holdings has a higher P/E than the average (13.6) P/E for companies in the entertainment industry.

That means that the market expects iDreamSky Technology Holdings will outperform other companies in its industry. Clearly the market expects growth, but it isn't guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Earnings growth rates have a big influence on P/E ratios. Earnings growth means that in the future the 'E' will be higher. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Most would be impressed by iDreamSky Technology Holdings earnings growth of 22% in the last year. And its annual EPS growth rate over 5 years is 31%. So one might expect an above average P/E ratio.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. So it won't reflect the advantage of cash, or disadvantage of debt. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

iDreamSky Technology Holdings's Balance Sheet

iDreamSky Technology Holdings's net debt is 7.6% of its market cap. It would probably trade on a higher P/E ratio if it had a lot of cash, but I doubt it is having a big impact.

The Bottom Line On iDreamSky Technology Holdings's P/E Ratio

iDreamSky Technology Holdings's P/E is 16.9 which is above average (10.1) in its market. The company is not overly constrained by its modest debt levels, and its recent EPS growth very solid. So on this analysis it seems reasonable that its P/E ratio is above average.

Investors have an opportunity when market expectations about a stock are wrong. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course you might be able to find a better stock than iDreamSky Technology Holdings. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1119

iDreamSky Technology Holdings

An investment holding company, operates a digital entertainment platform that publishes games through mobile apps and websites in the People’s Republic of China.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives