- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Should You Be Adding Canadian Natural Resources (TSE:CNQ) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Canadian Natural Resources (TSE:CNQ). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Canadian Natural Resources

Canadian Natural Resources's Improving Profits

Over the last three years, Canadian Natural Resources has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Canadian Natural Resources has grown its trailing twelve month EPS from CA$3.08 to CA$3.38, in the last year. That amounts to a small improvement of 9.8%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. To cut to the chase Canadian Natural Resources's EBIT margins dropped last year, and so did its revenue. That is, not a hint of euphemism here, suboptimal.

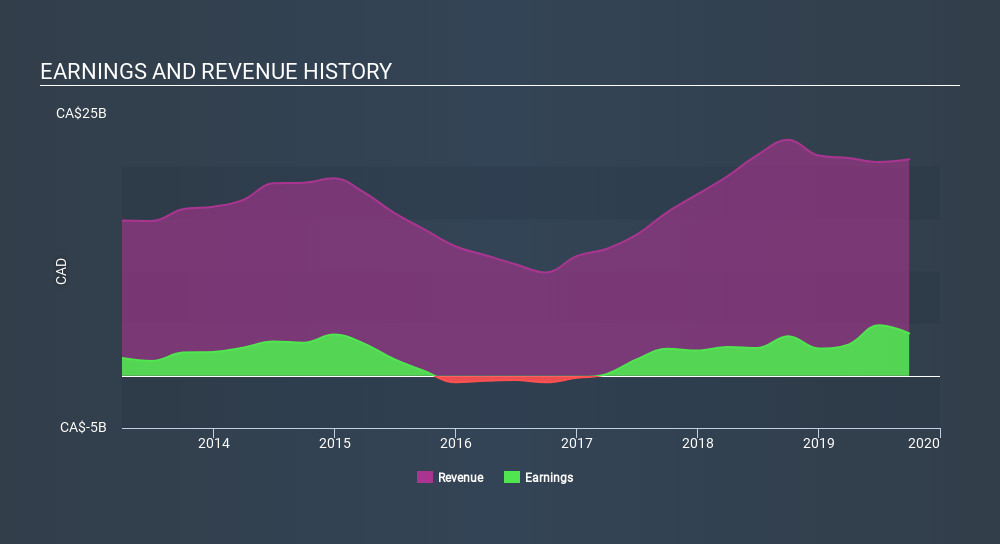

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Canadian Natural Resources's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Canadian Natural Resources Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a CA$44b company like Canadian Natural Resources. But we do take comfort from the fact that they are investors in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at CA$1.0b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations over CA$11b, like Canadian Natural Resources, the median CEO pay is around CA$9.3m.

The Canadian Natural Resources CEO received CA$7.2m in compensation for the year ending December 2018. That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Canadian Natural Resources Deserve A Spot On Your Watchlist?

One positive for Canadian Natural Resources is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for Canadian Natural Resources, but the pretty picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Of course, just because Canadian Natural Resources is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives