- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Shell (LSE:SHEL) Reports Q2 2025 Earnings With US$3,601 Million Net Income

Reviewed by Simply Wall St

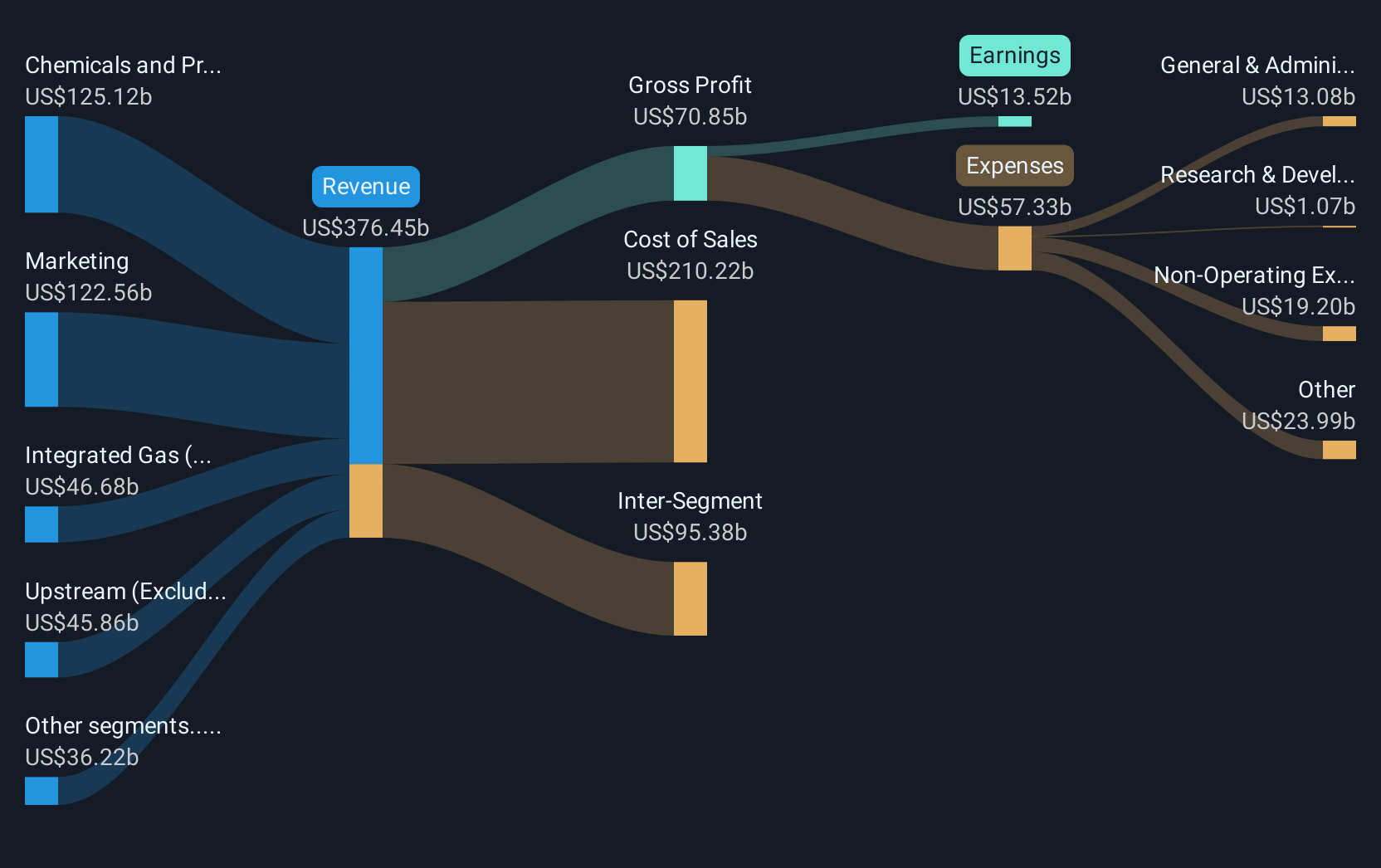

Shell (LSE:SHEL) recently announced its Q2 2025 performance, with net income rising slightly to USD 3,601 million despite a decrease in sales and revenue compared to the previous year. Alongside, the company maintained a consistent interim dividend, which could reinforce investor confidence. Over the last quarter, the company's share price increased by 9.95%, seemingly aligned with the broader market trend, where major indexes posted gains. The corporate guidance updates for Q3 could also have supported Shell's stock performance. Meanwhile, the overall positive sentiment in global markets, buoyed by strong earnings from tech giants like Microsoft and Meta, likely added favorable conditions for Shell's upward price movement.

We've identified 1 weakness for Shell that you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent announcement of Shell's Q2 2025 performance, with a net income of US$3.60 billion amidst lower sales and revenues, supports the narrative of Shell's focus on operational efficiency and cost reduction. The consistent interim dividend might boost investor confidence, aligning with the company's stated goals of enhanced shareholder returns through improved net margins and capital discipline. This development adds context to the anticipated impacts of AI and robotics in refining long-term operational performance, which might support better margin forecasts and earnings growth projections.

Over the past five years, Shell shares have delivered a total return of 172.27% inclusive of dividends, emphasizing its resilience and growth beyond short-term fluctuations. Over the recent year, however, Shell underperformed both the UK Oil and Gas industry, which returned 11.5%, and the broader UK market, which returned 10.1%. This underperformance could be linked to ongoing challenges in achieving immediate returns from new investments in renewable energy and the volatile LNG market.

Regarding revenue and earnings projections, the outlook indicates a gradual decrease in revenue by 1% annually over the next three years, while profit margins may increase from 4.8% to 7.5%. Such incremental profit growth aligns with Shell's strategies but underscores uncertainties in energy markets and regulatory environments. With the current share price at £26.79 and an analyst price target consensus of £30.83, there is a discounted opportunity of approximately 15%. The company's current trading price, along with potential buybacks, may provide opportunities for value realization if forecasted earnings and revenue targets are met.

Unlock comprehensive insights into our analysis of Shell stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives