- Australia

- /

- Metals and Mining

- /

- ASX:X64

Shareholders Are Thrilled That The Medusa Mining (ASX:MML) Share Price Increased 110%

Medusa Mining Limited (ASX:MML) shareholders might be concerned after seeing the share price drop 11% in the last month. But that doesn't change the fact that the returns over the last year have been very strong. Indeed, the share price is up an impressive 110% in that time. So we think most shareholders won't be too upset about the recent fall. More important, going forward, is how the business itself is going.

Check out our latest analysis for Medusa Mining

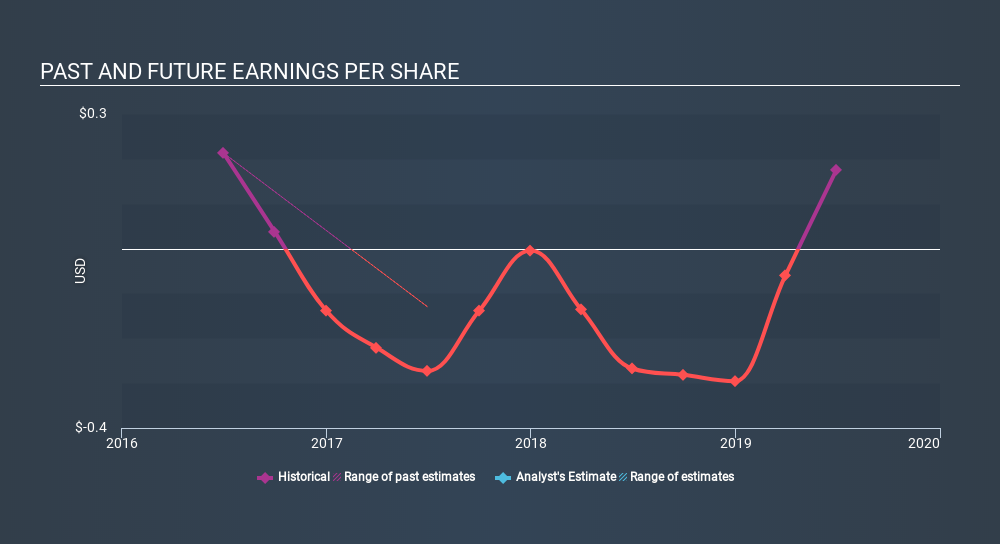

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Medusa Mining went from making a loss to reporting a profit, in the last year.

We think the growth looks very prospective, so we're not surprised the market liked it too. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Medusa Mining's key metrics by checking this interactive graph of Medusa Mining's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Medusa Mining shareholders have received a total shareholder return of 110% over one year. That certainly beats the loss of about 3.3% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Medusa Mining .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:X64

Ten Sixty Four

Engages in the exploration, evaluation, development, production, and sale of mineral properties in the Asia Pacific.

Flawless balance sheet medium.

Similar Companies

Market Insights

Community Narratives