- United States

- /

- Healthcare Services

- /

- OTCPK:BIMI

Shareholders Are Raving About How The NF Energy Saving (NASDAQ:BIMI) Share Price Increased 328%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

NF Energy Saving Corporation (NASDAQ:BIMI) shareholders might understandably be very concerned that the share price has dropped 49% in the last quarter. But that doesn't change the fact that the returns over the last three years have been spectacular. Over that time, we've been excited to watch the share price climb an impressive 328%. So the recent fall doesn't do much to dampen our respect for the business. The share price action could signify that the business itself is dramatically improved, in that time.

See our latest analysis for NF Energy Saving

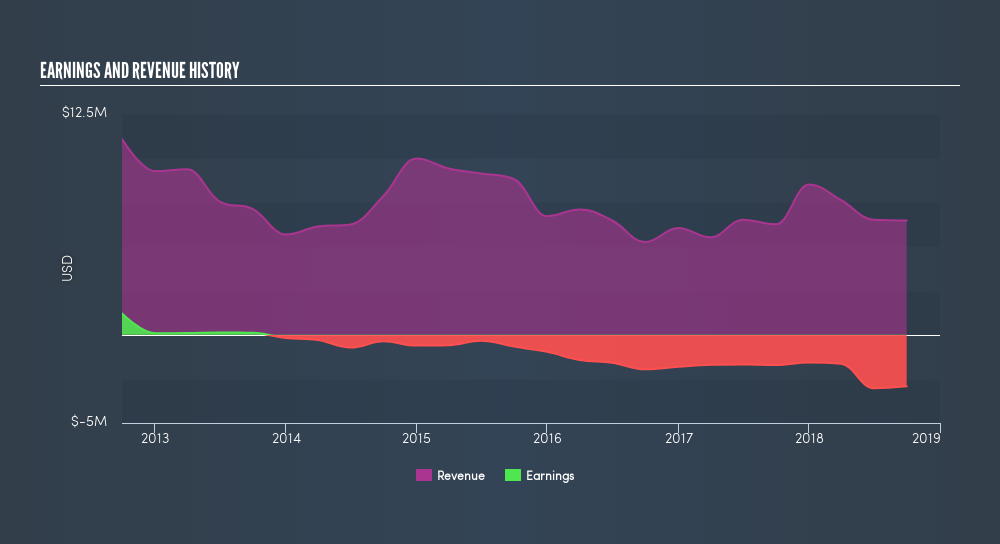

NF Energy Saving isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years NF Energy Saving saw its revenue shrink by 1.4% per year. So it's pretty amazing to see the stock price has zoomed up 62% per year in that time. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of NF Energy Saving's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 9.4% in the last year, NF Energy Saving shareholders lost 9.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 2.4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of NF Energy Saving by clicking this link.

NF Energy Saving is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:BIMI

BIMI Holdings

Engages in the retail and wholesale distribution of medical devices, and pharmaceutical and other healthcare products in the People’s Republic of China.

Low with weak fundamentals.

Market Insights

Community Narratives