Shareholders Are Loving iA Financial Corporation Inc.'s (TSE:IAG) 4.6% Yield

Dividend paying stocks like iA Financial Corporation Inc. (TSE:IAG) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

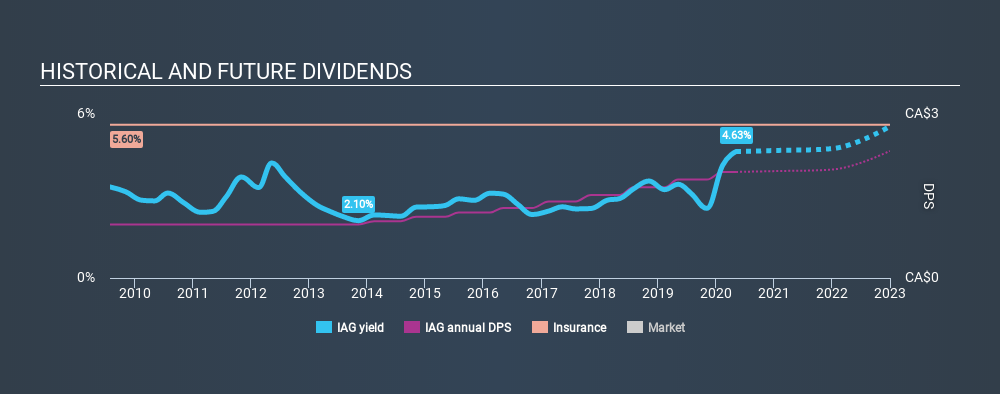

In this case, iA Financial likely looks attractive to investors, given its 4.6% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. Remember that the recent share price drop will make iA Financial's yield look higher, even though recent events might have impacted the company's prospects. Some simple research can reduce the risk of buying iA Financial for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. iA Financial paid out 35% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

Consider getting our latest analysis on iA Financial's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of iA Financial's dividend payments. During this period the dividend has been stable, which could imply the business could have relatively consistent earnings power. During the past ten-year period, the first annual payment was CA$0.98 in 2010, compared to CA$1.94 last year. This works out to be a compound annual growth rate (CAGR) of approximately 7.1% a year over that time.

Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Earnings have grown at around 6.1% a year for the past five years, which is better than seeing them shrink! Earnings per share have been growing at a credible rate. What's more, the payout ratio is reasonable and provides some protection to the dividend, or even the potential to increase it.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're glad to see iA Financial has a low payout ratio, as this suggests earnings are being reinvested in the business. Earnings growth has been limited, but we like that the dividend payments have been fairly consistent. iA Financial has a credible record on several fronts, but falls slightly short of our standards for a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 2 warning signs for iA Financial (1 is significant!) that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion