- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Shareholders Approve Bylaw Amendments at Regeneron Pharmaceuticals (NasdaqGS:REGN) Annual Meeting

Reviewed by Simply Wall St

Regeneron Pharmaceuticals (NasdaqGS:REGN) recently conducted its Annual General Meeting, resulting in approved changes to its company bylaws. The amendments, along with the promising results from the EVEREST Phase 4 study, indicate strong governance and product development. Despite these developments, the company's share price remained relatively flat over the past week, aligning with the broader market's stability. While the market showed a 9.9% rise over the past year and anticipates a 15% annual earnings growth, the past week's events might have lent weight to this upward trend, yet they did not result in a notable price shift for Regeneron.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

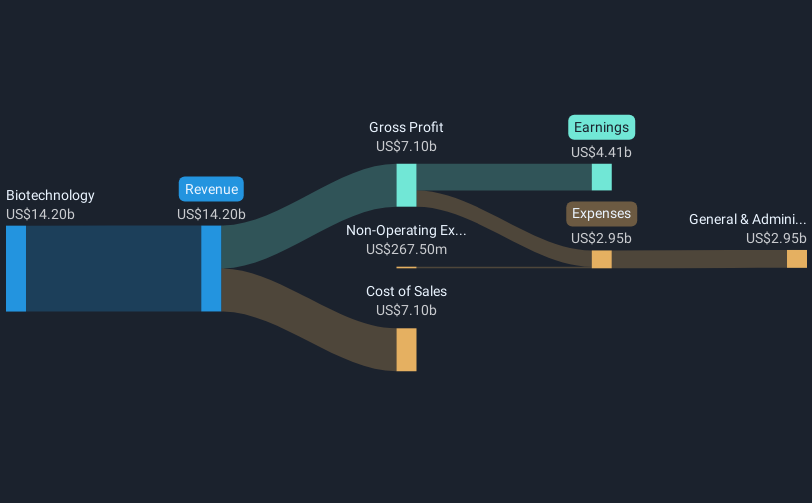

Regeneron Pharmaceuticals' recent governance enhancements and promising drug trial results highlighted at the Annual General Meeting suggest solid groundwork for potential growth. However, the short-term stability in share price implies these developments have not yet fully influenced market sentiment. Over a longer-term period, specifically three years, the company's total return, including share price and dividends, has declined by 12.24%, suggesting challenges in maintaining momentum in a highly competitive biotech landscape.

While the broader market showed a 9.9% rise over the past year, Regeneron underperformed, emphasizing the need for effective execution of its strategic initiatives. The anticipation surrounding the EVEREST study and other pipeline advancements could positively affect revenue and earnings forecasts, potentially aligning future market expectations with current analyst projections for a price target of US$727.21, given the current price of US$558.52. This presents an opportunity for price appreciation should Regeneron successfully capitalize on its expansive product pipeline and strategic investments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives