Seya Industries Limited (NSE:SEYAIND) Doing What It Can To Lift Shares

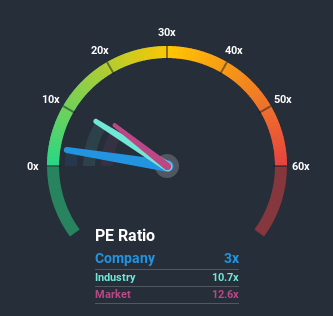

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 13x, you may consider Seya Industries Limited (NSE:SEYAIND) as a highly attractive investment with its 3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Seya Industries' financial performance has been poor lately as it's earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Seya Industries

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Seya Industries would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. Even so, admirably EPS has lifted 63% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

In contrast to the company, the rest of the market is expected to decline by 6.7% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that Seya Industries is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Seya Industries revealed its growing earnings over the medium-term aren't contributing to its P/E anywhere near as much as we would have predicted, given the market is set to shrink. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

It is also worth noting that we have found 4 warning signs for Seya Industries (1 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Seya Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you decide to trade Seya Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SEYAIND

Seya Industries

Manufactures and sells specialty chemicals in India and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026