- China

- /

- Metals and Mining

- /

- SHSE:601388

September 2025's Global Penny Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and mixed economic signals, investors are increasingly seeking opportunities beyond traditional avenues. Penny stocks, though an outdated term, still represent a niche area where smaller or newer companies can offer surprising value. With solid financial foundations, these stocks have the potential to provide compelling opportunities with greater stability than one might expect.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.52 | HK$971.08M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$417.98M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.655 | MYR333.05M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.38 | MYR554.14M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.23 | SGD12.71B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,729 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Yechiu Metal Recycling (China) (SHSE:601388)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry across Asia and the United States, with a market cap of CN¥6.36 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥6.36B

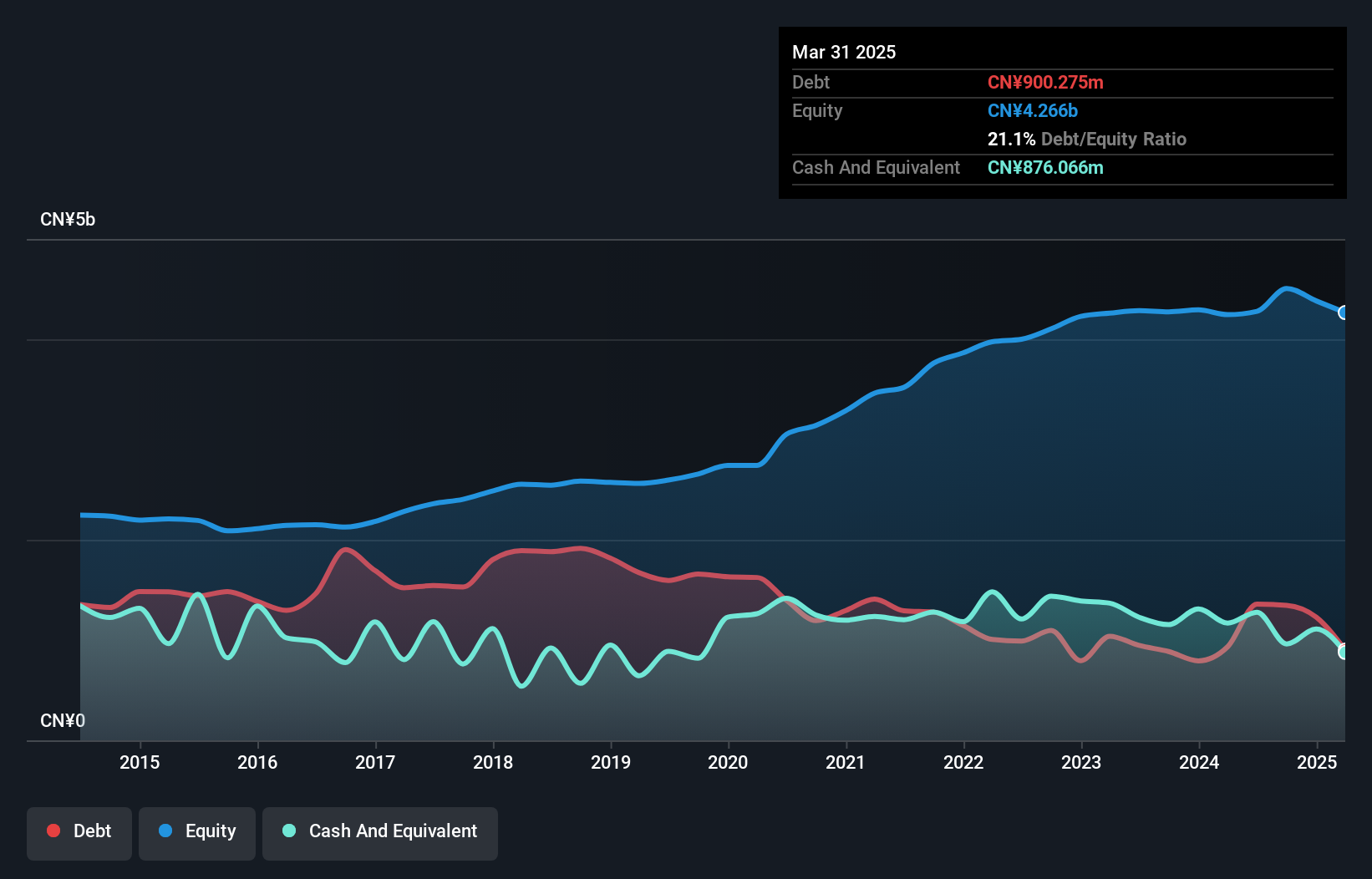

Yechiu Metal Recycling (China) Ltd. recently reported half-year revenue of CN¥3.58 billion, up from CN¥3.24 billion the previous year, yet net income fell to CN¥29.39 million from CN¥68.53 million, highlighting profitability challenges despite revenue growth. The company has reduced its debt-to-equity ratio significantly over five years, indicating improved financial health and a satisfactory net debt level of 1.3%. However, its negative return on equity and insufficient interest coverage suggest ongoing financial strain as it remains unprofitable with declining earnings over the past five years at a rate of 37.1% annually.

- Unlock comprehensive insights into our analysis of Yechiu Metal Recycling (China) stock in this financial health report.

- Review our historical performance report to gain insights into Yechiu Metal Recycling (China)'s track record.

Dezhan Healthcare (SZSE:000813)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dezhan Healthcare Company Limited focuses on the research, development, manufacture, and sale of cardiovascular and cerebrovascular drugs in China with a market cap of CN¥8.63 billion.

Operations: The company's revenue from its operations in China amounts to CN¥384.20 million.

Market Cap: CN¥8.63B

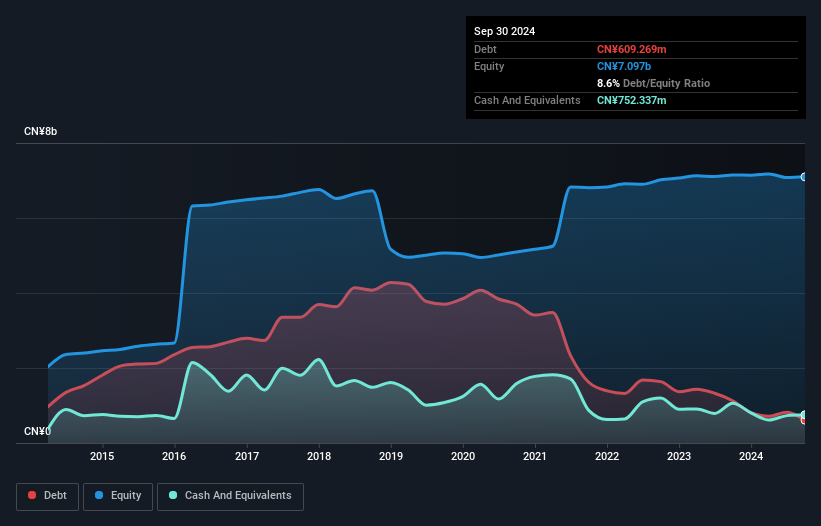

Dezhan Healthcare's recent activities include significant changes in its board and amendments to its articles of association. The company reported a net loss of CN¥42.93 million for the first half of 2025, with revenue declining to CN¥166.36 million from CN¥248.32 million the previous year, indicating financial challenges despite having more cash than total debt and a stable management team with experienced leadership. The company's share buyback program reduced outstanding shares by 3.15%, reflecting an effort to enhance shareholder value amid high volatility and ongoing unprofitability, as earnings have declined over recent years at a substantial rate.

- Click here and access our complete financial health analysis report to understand the dynamics of Dezhan Healthcare.

- Gain insights into Dezhan Healthcare's past trends and performance with our report on the company's historical track record.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. engages in the research, development, manufacturing, and sale of Chinese herbal medicines and other pharmaceutical products both in China and internationally, with a market cap of CN¥6.54 billion.

Operations: The company's revenue is primarily derived from Pharmaceutical Distribution (CN¥4.45 billion), Medical Services (CN¥1.62 billion), and Pharmaceutical Manufacturing (CN¥972.48 million).

Market Cap: CN¥6.54B

Guizhou Xinbang Pharmaceutical's recent amendments to its articles of association and interim dividend distribution reflect active shareholder engagement. Despite a decline in earnings, with net income at CN¥107.2 million for the first half of 2025, the company maintains a strong financial position with more cash than total debt and short-term assets exceeding liabilities. However, profit margins have decreased from last year, and earnings growth has been negative over the past year. While its management team is seasoned with an average tenure of 10.3 years, the board remains relatively inexperienced with an average tenure of two years.

- Take a closer look at Guizhou Xinbang Pharmaceutical's potential here in our financial health report.

- Understand Guizhou Xinbang Pharmaceutical's track record by examining our performance history report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 3,729 Global Penny Stocks here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601388

Yechiu Metal Recycling (China)

Engages in aluminum alloy recycling business in Asia and the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives