Sanofi (ENXTPA:SAN) Reports Positive Phase 3 Results for Itepekimab in COPD Trial

Reviewed by Simply Wall St

Sanofi (ENXTPA:SAN) announced that its AERIFY-1 trial with Regeneron Pharmaceuticals successfully met its primary endpoint, indicating progress in COPD treatment. Despite this positive news, the company's share price fell 5% over the last week, contrasting with a 2% rise in the broader market. This decline may reflect investors’ reactions to other company initiatives, such as its partnership with Stagecoach Performing Arts to raise awareness of autoimmune Type 1 diabetes. These positive developments, although promising, were not enough to counterbalance the broader market's upward trend, contributing weight against Sanofi's price movement.

Buy, Hold or Sell Sanofi? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent successful completion of Sanofi's AERIFY-1 trial could have a positive impact on its revenue and earnings forecasts by strengthening its position in the COPD treatment market. However, despite these promising developments, the company's share price experienced a 5% decline in the past week, contrasting with the broader market's 2% rise. This movement might reflect investor reactions to other company initiatives, such as the partnership with Stagecoach Performing Arts, and broader market trends.

Looking at a longer-term context, Sanofi's shares have delivered a total return of 19.59% over the past five years. Recent performance has exceeded the French Pharmaceuticals industry and market, which returned 4% and 4.5% declines respectively over the last year. Such outperformance indicates resilience amidst industry challenges and market volatility.

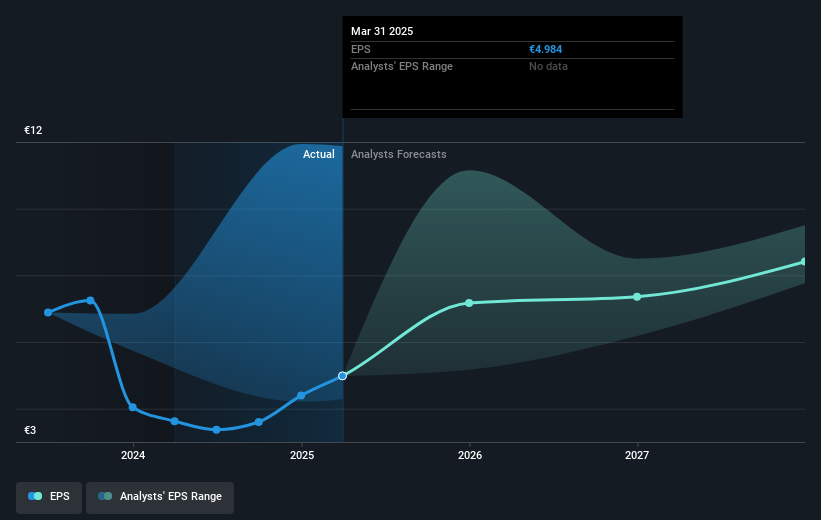

Please consider the current share price of €95.9 against the consensus price target of €117.17, indicating a potential upside potential of approximately 18.5%. This price target is based on expectations of revenue reaching €51.2 billion and earnings of €10.2 billion by 2028, trading on a PE ratio of 16.1x. Analysts are assuming that Sanofi will enhance its growth trajectory driven by its innovative treatments and efficient operational strategies.

Assess Sanofi's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

Engages in the research, development, manufacture, and marketing of therapeutic solutions.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion