Sanofi (ENXTPA:SAN) Gains FDA Approval For Dupixent To Address Rare Skin Disease

Reviewed by Simply Wall St

Sanofi (ENXTPA:SAN) experienced a 4% decline over the past week despite a largely unchanged market. The recent events, including the FDA approval of Dupixent for a rare skin condition and the signing of a memorandum with the Department of Health - Abu Dhabi, signal positive developments for its collaborative efforts with Regeneron and internal growth strategies. Although these announcements are significant, they were not sufficient to counteract the broader move, which might have been influenced by other factors specific to Sanofi, such as its recent €1.5 billion notes offering aimed at supporting corporate purposes.

Buy, Hold or Sell Sanofi? View our complete analysis and fair value estimate and you decide.

The recent developments for Sanofi, including FDA approval of Dupixent for a rare skin condition and the memorandum with the Department of Health - Abu Dhabi, highlight efforts to enhance revenue growth through expanded market reach and innovation. Despite these positive updates, Sanofi shares experienced a 4% decline over the past week, influenced by factors such as the recent €1.5 billion notes offering. Over a longer-term period, Sanofi achieved a total shareholder return of 11.29% over five years.

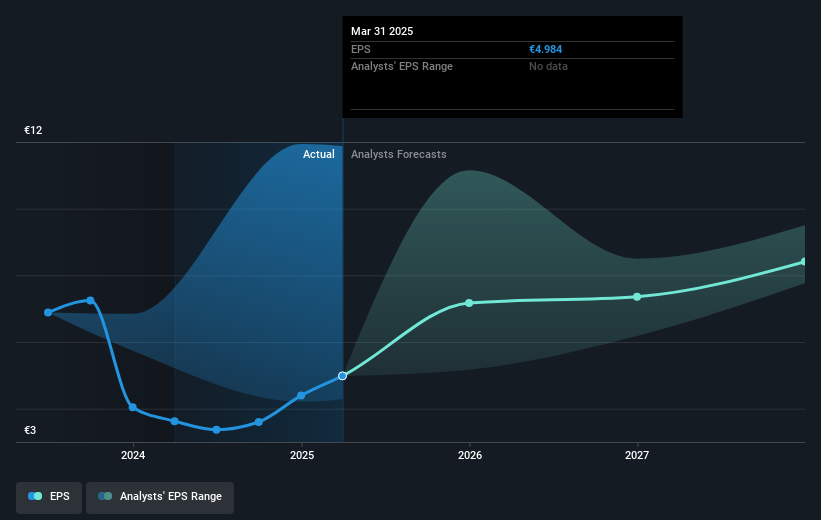

Comparatively, over the past year, Sanofi's performance matched the French Pharmaceuticals industry, which reported a similar decline of 5.9%. In contrast, the broader French Market fared slightly better, returning 2.2%. The recent news related to Dupixent and international partnerships could potentially boost Sanofi’s revenue and earnings forecasts, providing a catalyst for future growth given the innovative pipeline and market penetration opportunities.

Considering the current share price of €95.9 and the analyst consensus price target of €117.7, there is potential for an 18.5% increase, according to market projections. These developments need to be weighed against existing market conditions and company fundamentals, as analysts remain divided on future earnings prospects and valuations.

Click here to discover the nuances of Sanofi with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

A healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives