Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Sands China Ltd. (HKG:1928) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Sands China

What Is Sands China's Debt?

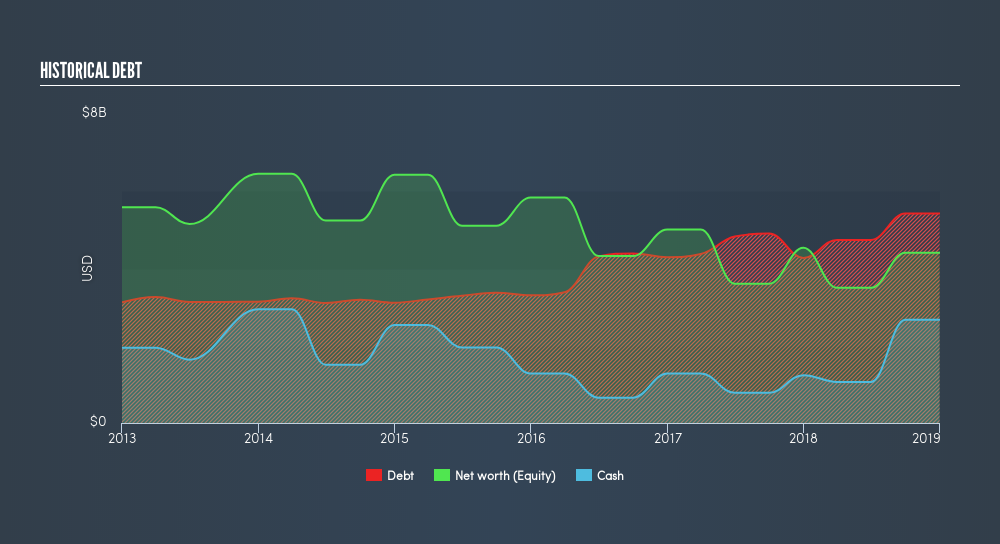

The image below, which you can click on for greater detail, shows that at December 2018 Sands China had debt of US$5.56b, up from US$4.41b in one year. However, it does have US$2.68b in cash offsetting this, leading to net debt of about US$2.89b.

A Look At Sands China's Liabilities

According to the last reported balance sheet, Sands China had liabilities of US$1.94b due within 12 months, and liabilities of US$5.71b due beyond 12 months. On the other hand, it had cash of US$2.68b and US$427.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.55b.

Since publicly traded Sands China shares are worth a very impressive total of US$40.7b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Sands China has a low net debt to EBITDA ratio of only 0.99. And its EBIT covers its interest expense a whopping 11.5 times over. So we're pretty relaxed about its super-conservative use of debt. On top of that, Sands China grew its EBIT by 31% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Sands China's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Sands China actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, Sands China's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Overall, we don't think Sands China is taking any bad risks, as its debt load seems modest. So the balance sheet looks pretty healthy, to us. Given Sands China has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1928

Sands China

Develops, owns, and operates integrated resorts and casinos in Macao.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives