- United States

- /

- Software

- /

- NYSE:IOT

Samsara (NYSE:IOT) Partners With Element Fleet Management For Enhanced Fleet Solutions

Reviewed by Simply Wall St

On June 10, 2025, Samsara (NYSE:IOT) announced a partnership with Element Fleet Management Corp, introducing a comprehensive fleet management solution designed to enhance safety and efficiency using data-driven insights. This alliance, coupled with other positive developments such as higher-than-expected earnings growth and new AI-powered product features, aligns with the overall market trend, where the S&P 500 and Nasdaq have shown steady gains. Samsara's strategic moves likely supported its 10% share price increase over the last quarter, contributing to the broader upward momentum, which has been buoyed by easing inflation concerns and positive trade talks.

You should learn about the 2 risks we've spotted with Samsara.

The partnership between Samsara and Element Fleet Management Corp marks a significant step in enhancing data-driven fleet management solutions, likely reinforcing the company’s narrative of strong growth in recurring revenue and enterprise client acquisition. This could position Samsara to tap into under-penetrated markets, aligning with the company's narrative of expansion opportunities.

Over the last three years, Samsara shares achieved an impressive total return of 291.60%, highlighting robust long-term performance. In the previous year, Samsara outpaced the US Software industry, which returned 21%, indicating superior annual growth.

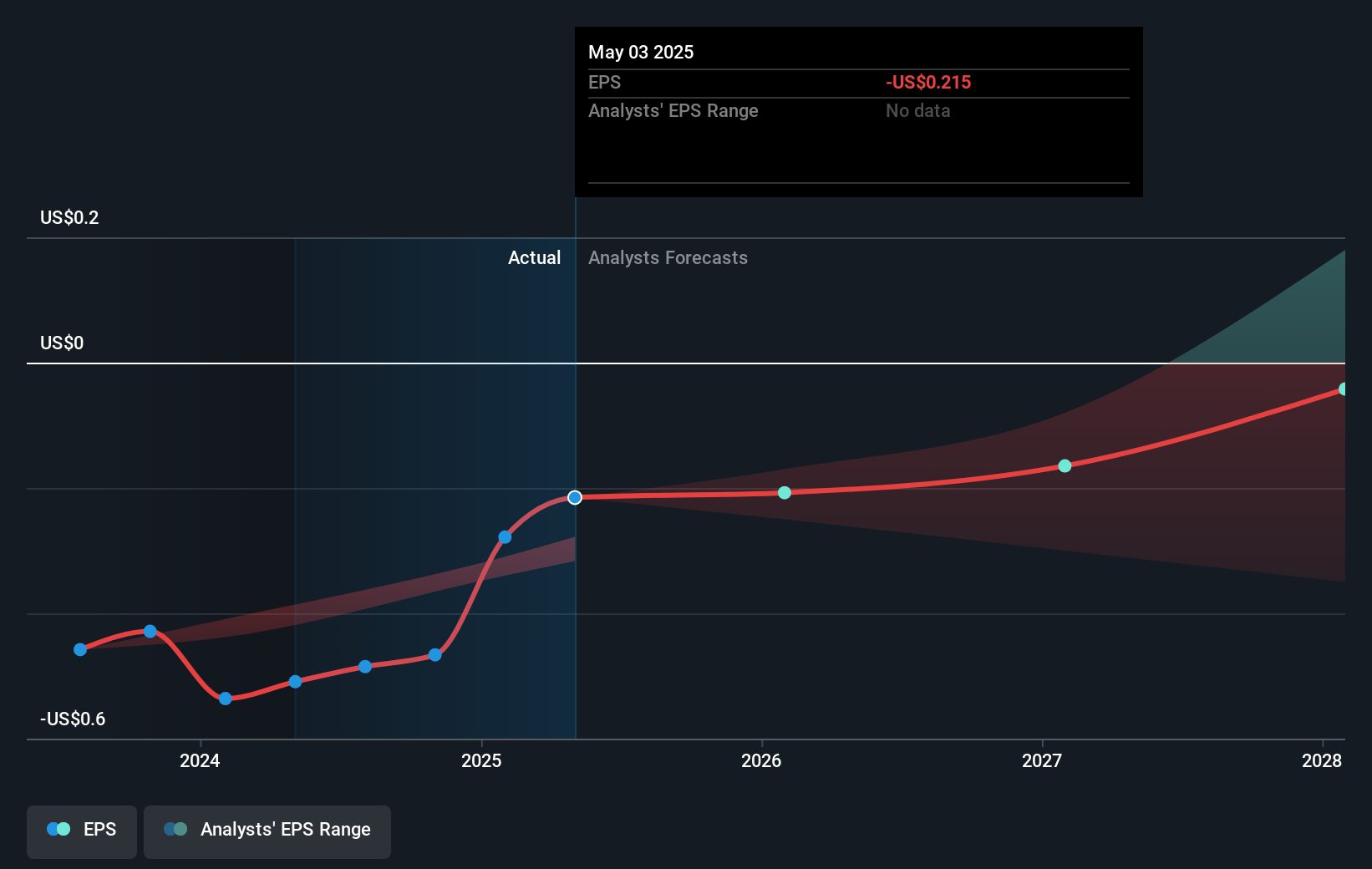

The recent developments, including AI-powered product innovations, could positively influence revenue trajectories and earnings forecasts. While Samsara is currently unprofitable, the anticipated revenue growth of 19.4% per year may signal future profitability potential, though analysts expect it to remain unprofitable in the short term.

Despite a recent share price increase, Samsara's stock is priced at US$39.24, which is slightly below the consensus analyst price target of US$47.06, indicating an upward potential of 16.6%. However, investors should weigh this against the company's current losses and potential risks.

Learn about Samsara's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives