- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:RKLB

Rocket Lab (NasdaqCM:RKLB) Launches Successful Mission for BlackSky's Earth-Imaging Satellites

Reviewed by Simply Wall St

Rocket Lab (NasdaqCM:RKLB) recently achieved a significant milestone with the successful launch of its 65th Electron rocket, part of the 'Full Stream Ahead' mission, which may have positively influenced its stock price increase of 40% last quarter. This upward move starkly contrasts with the broader market trend, adding momentum to the company's position forward. Other relevant events include the acquisition of Geost, aimed at reinforcing its offerings in the U.S. National Security sector, and a successful synthetic aperture radar satellite launch for a Japanese client. These developments underline Rocket Lab's expanding operational scope and market appeal.

Rocket Lab has 2 risks we think you should know about.

The achievements highlighted, such as the 65th successful Electron launch and the strategic acquisition of Geost, could enhance Rocket Lab's revenue and earnings forecasts by reinforcing its market standing and potentially attracting further contracts. These developments are likely to support the company's operational expansion and broaden its service offerings, notably in the U.S. National Security sector.

Over a very large one-year period, Rocket Lab's total shareholder return reached a remarkable level, demonstrating significant appreciation in its share price. In comparison, while the company's 40% share price increase last quarter was impressive, its performance over the previous year far exceeded both the US Market and the Aerospace & Defense industry.

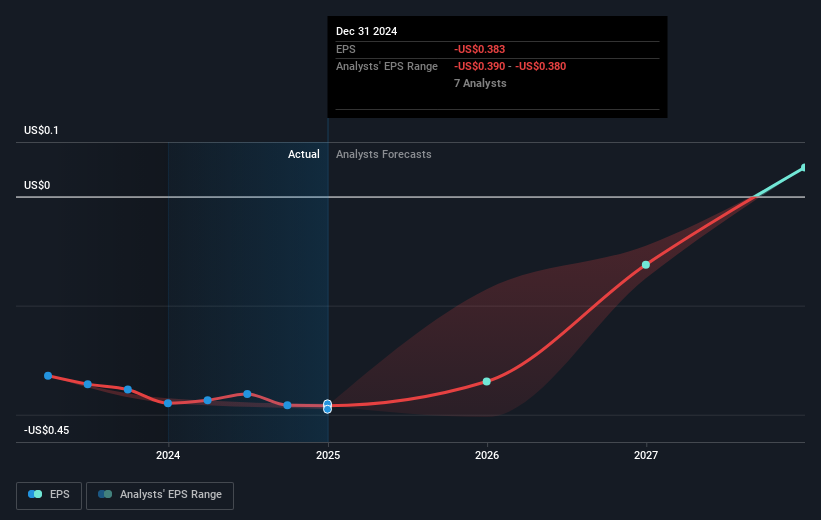

Looking forward, such achievements may contribute positively to a forecasted revenue rise, potentially reaching US$1.2 billion by 2028. Analysts expect increased earnings, foreseeing growth from US$190.2 million in losses to US$59.1 million in profits within three years. The recent share price momentum places it closer to analysts' average price target of US$24.6, a 9.0% premium over the current US$22.4 valuation. Compared to analyst projections, this indicates confidence in future revenue, though the reliance on ambitious targets and execution presents inherent risks.

Take a closer look at Rocket Lab's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RKLB

Rocket Lab

A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives