- United Kingdom

- /

- Commercial Services

- /

- LSE:RTO

Rentokil Initial plc's (LON:RTO) 1.2% Dividend Yield Looks Pretty Interesting

Today we'll take a closer look at Rentokil Initial plc (LON:RTO) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

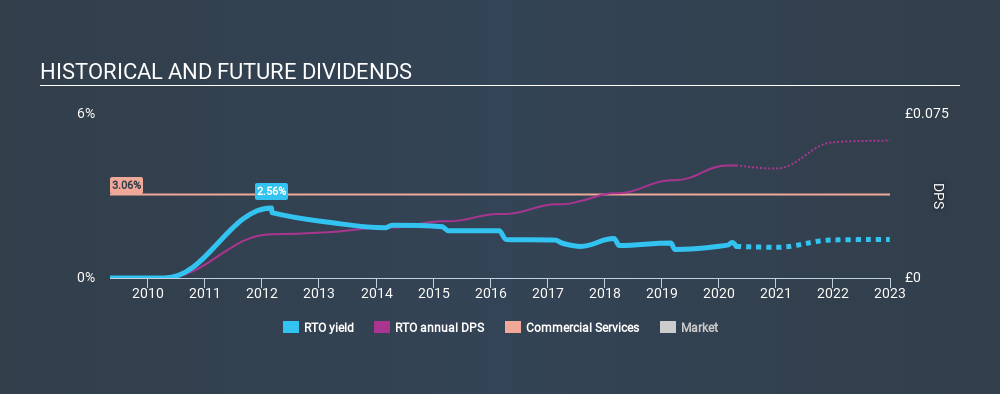

Investors might not know much about Rentokil Initial's dividend prospects, even though it has been paying dividends for the last eight years and offers a 1.2% yield. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. There are a few simple ways to reduce the risks of buying Rentokil Initial for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Rentokil Initial paid out 34% of its profit as dividends, over the trailing twelve month period. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Plus, there is room to increase the payout ratio over time.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Rentokil Initial's cash payout ratio in the last year was 29%, which suggests dividends were well covered by cash generated by the business. It's positive to see that Rentokil Initial's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Consider getting our latest analysis on Rentokil Initial's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The first recorded dividend for Rentokil Initial, in the last decade, was eight years ago. The dividend has been quite stable over the past eight years, which is great to see - although we usually like to see the dividend maintained for a decade before giving it full marks, though. During the past eight-year period, the first annual payment was UK£0.02 in 2012, compared to UK£0.051 last year. Dividends per share have grown at approximately 13% per year over this time.

Rentokil Initial has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Rentokil Initial has grown its earnings per share at 17% per annum over the past five years. A company paying out less than a quarter of its earnings as dividends, and growing earnings at more than 10% per annum, looks to be right in the cusp of its growth phase. At the right price, we might be interested.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. It's great to see that Rentokil Initial is paying out a low percentage of its earnings and cash flow. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Overall we think Rentokil Initial scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. To that end, Rentokil Initial has 3 warning signs (and 1 which is significant) we think you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:RTO

Rentokil Initial

Provides route-based services in North America, Europe, the United Kingdom, Asia, the Middle East, North Africa, Turkey, and Pacific.

Average dividend payer low.

Similar Companies

Market Insights

Community Narratives