It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So shareholders might well want to know whether insiders have been buying or selling shares in Fiducian Group Limited (ASX:FID).

What Is Insider Buying?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for Fiducian Group

The Last 12 Months Of Insider Transactions At Fiducian Group

The Independent Director, Robert Bucknell, made the biggest insider sale in the last 12 months. That single transaction was for AU$285k worth of shares at a price of AU$5.67 each. That means that an insider was selling shares at around the current price of AU$4.98. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

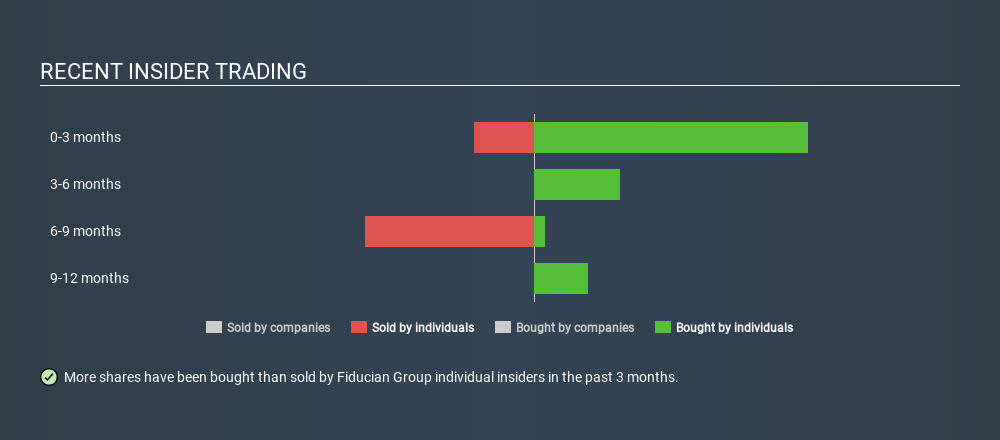

Over the last year, we can see that insiders have bought 196.22k shares worth AU$866k. But insiders sold 105538 shares worth AU$544k. In total, Fiducian Group insiders bought more than they sold over the last year. Their average price was about AU$4.41. These transactions show that insiders have confidence to invest their own money in the stock, albeit at slightly below the recent price. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Fiducian Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insiders at Fiducian Group Have Bought Stock Recently

At Fiducian Group,over the last quarter, we have observed quite a lot more insider buying than insider selling. In fact, two insiders bought AU$332k worth of shares. On the other hand, Founder Inderjit Singh netted AU$106k by selling. We think insiders may be optimistic about the future, since insiders have been net buyers of shares.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Fiducian Group insiders own 43% of the company, currently worth about AU$68m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Fiducian Group Insider Transactions Indicate?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about Fiducian Group. That's what I like to see! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Fiducian Group. To assist with this, we've discovered 2 warning signs that you should run your eye over to get a better picture of Fiducian Group.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ASX:FID

Fiducian Group

Through its subsidiaries, provides financial services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives