- Canada

- /

- Professional Services

- /

- TSX:TRI

Read This Before Buying Thomson Reuters Corporation (TSE:TRI) For Its Dividend

Dividend paying stocks like Thomson Reuters Corporation (TSE:TRI) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

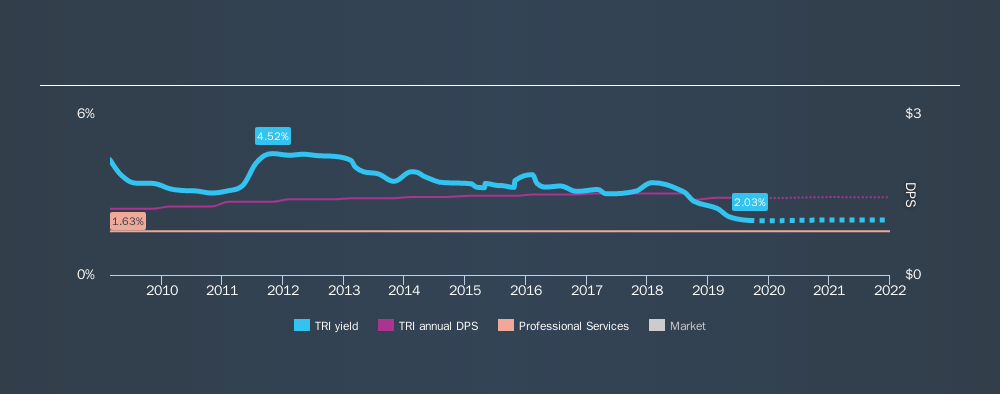

A 2.0% yield is nothing to get excited about, but investors probably think the long payment history suggests Thomson Reuters has some staying power. The company also bought back stock during the year, equivalent to approximately 21% of the company's market capitalisation at the time. There are a few simple ways to reduce the risks of buying Thomson Reuters for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Thomson Reuters!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Thomson Reuters paid out 461% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Thomson Reuters paid out 187% of its free cash flow last year, which we think is concerning if cash flows do not improve. Paying out such a high percentage of cash flow suggests that the dividend was funded from either cash at bank or by borrowing, neither of which is desirable over the long term. Cash is slightly more important than profit from a dividend perspective, but given Thomson Reuters's payouts were not well covered by either earnings or cash flow, we would definitely be concerned about the sustainability of this dividend.

Is Thomson Reuters's Balance Sheet Risky?

As Thomson Reuters's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). Thomson Reuters has net debt of 1.09 times its EBITDA, which we think is not too troublesome.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 3.94 times its interest expense, Thomson Reuters's interest cover is starting to look a bit thin.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Thomson Reuters's dividend payments. This dividend has been unstable, which we define as having fallen by at least 20% one or more times over this time. During the past ten-year period, the first annual payment was US$1.23 in 2009, compared to US$1.44 last year. This works out to be a compound annual growth rate (CAGR) of approximately 1.6% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments, we don't think this is an attractive combination.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Thomson Reuters has grown its earnings per share at 12% per annum over the past five years. Paying out more in dividends than was reported as profit can make sense in some cases, we would be inclined to avoid a company doing this, unless there were a solid reason.

Conclusion

To summarise, shareholders should always check that Thomson Reuters's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Thomson Reuters paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. With this information in mind, we think Thomson Reuters may not be an ideal dividend stock.

Earnings growth generally bodes well for the future value of company dividend payments. See if the 16 Thomson Reuters analysts we track are forecasting continued growth with our free report on analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion